Know Your Burn Rate - Set Up Your Assessment Framework

Stephen Blank describes a startup as an organization formed to search for a repeatable, scalable, profitable business model. They are not small versions of large corporations.

A well-run startup is like a laboratory, testing hypotheses, comparing actual results against expected results, and constantly executing small pivots until a company is born.

Or unit the cash runs out and your experiment is deemed a failure.

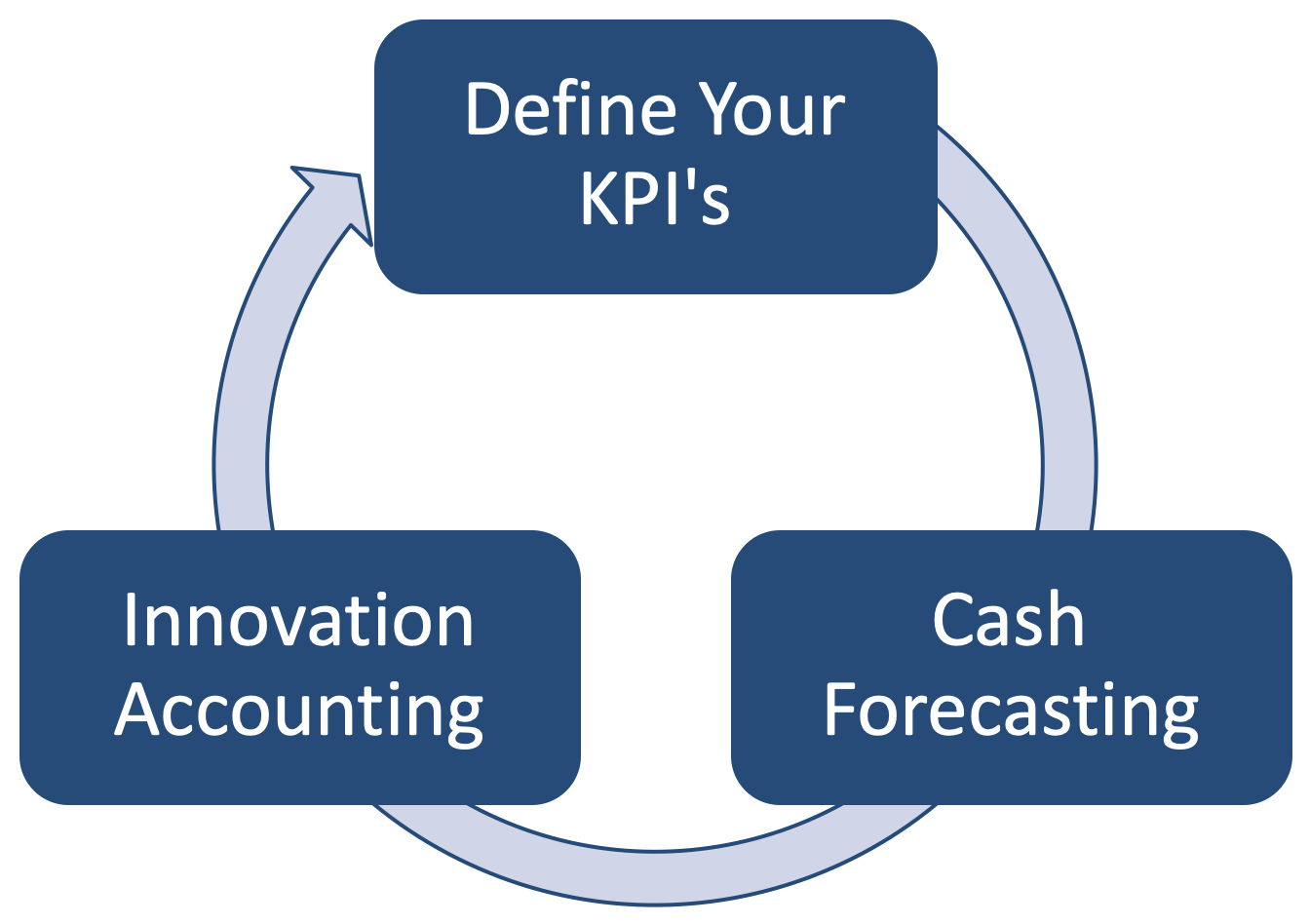

To properly run your startup laboratory, you need to get an assessment framework in place.

We are going to break this process down in quite a bit of detail over the course of future posts, but for now, let’s lay out the basics.

The fundamental question every founder should be able to answer is “How long is my cash runway?” Cash runway is simply the amount of cash in your bank divided by your burn rate. It represents the number of months of cash you have before your bank account runs dry.

Now, that all sounds obvious and fairly straightforward. But nearly every founder I meet does not know their runway. They are operating off of a business plan that isn’t connected to their most important KPI’s. Their financial forecast is a series of high level guesses about revenue growth rate, and they are using their profit forecast as a proxy for cash flow.

This is like driving at night with your headlights off.

Before you build your P&L forecast, you need to take a step back and make sure you understand your fundamental business model. What are the customer focused KPI’s that most directly connect your customer to revenue? How are you going to find those customers, and what is it going to cost to acquire them? Once you have them in your funnel, how often will they convert, and how do you think about customer retention and repeat purchase behavior?

You need to understand your cost of sales and your gross margin. And the key metrics that impact the numbers between Gross Revenue and Gross Profit.

Defining these customer focused KPI’s, and using those initial expectations, should serve as the foundation for building your P&L forecast. Your P&L forecast then serves as the foundation for your cash flow model.

Profit and cash flow are not the same!

The timing differences that impact cash flow can create dramatic variations in the amount of cash you might need to fund early operations or a rapid ramp in growth rates.

By connecting your KPI’s to your P&L, and your P&L to your cash flow, once you launch your MVP and start to get data, you can quickly assess the impact of actual performance vs. expected performance on your cash runway. Variations in expected KPI’s can easily be modeled against your financial plan.

And now you’re ready to run through your Innovation Accounting framework. This is a concept from the Lean Startup, and if you haven’t yet read the book, you should. Innovation Accounting is a framework designed to support iterating on your MVP until your KPI’s produce results that identify product-market fit and a path to a sustainable business model.

The term product-market fit is often used as a bar of success. I prefer the phrase profitable, scalable product-market fit. You should be watching your KPI’s as you move through the Innovation Accounting cycle, making small pivots along the way until you see a path to profitable, scalable growth.

You now have an Assessment framework in place that you can use to find your path to profitable, scalable growth.

As you work through your Innovation Accounting cycle, you’ll be updating your KPI’s based upon real data, flowing that through your cash flow, and keeping an eye on your cash runway.

Your goal is to repeat this cycle as fast, and as often, as you can until you either find that sustainable business model or run out of cash.