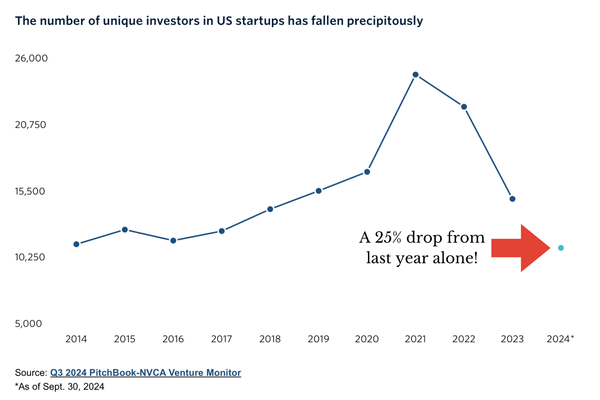

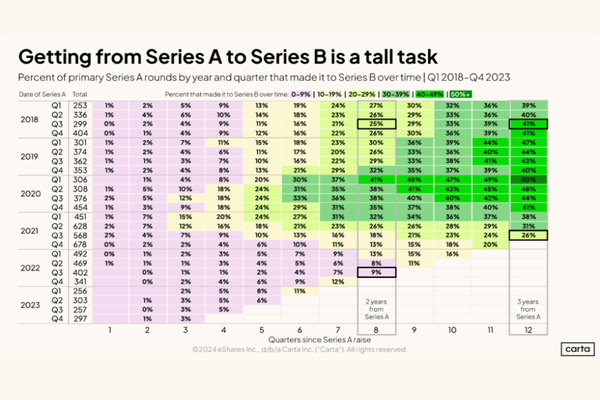

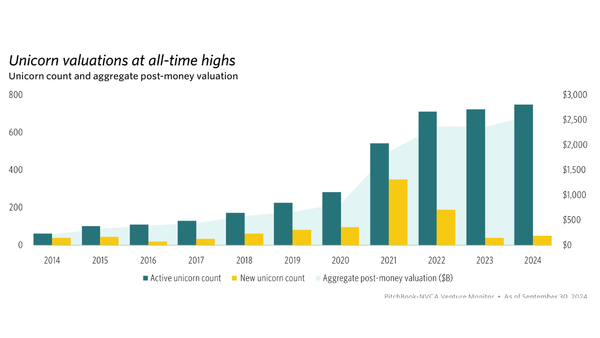

Funding

SBA Cuts Nearly Half Its Workforce

The SBA just announced a 43% staff cut in a major reorg. For founders relying on government programs, this could mean fewer resources and slower support. Here's what this shift means for your funding strategy—and how to stay in control.