Why Longer Fundraising Cycles Are Good for Startups

It's taking longer to raise a round of venture funding. This is a healthy change. Let me explain why.

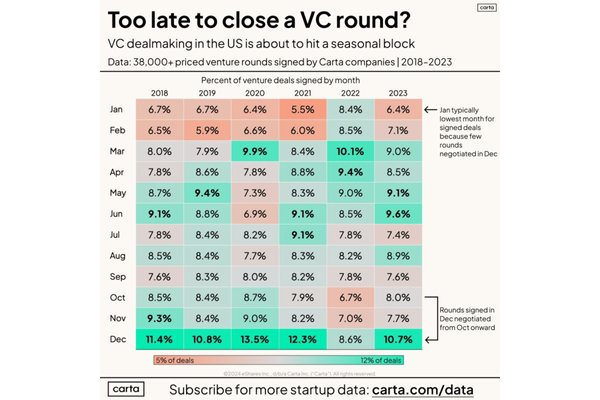

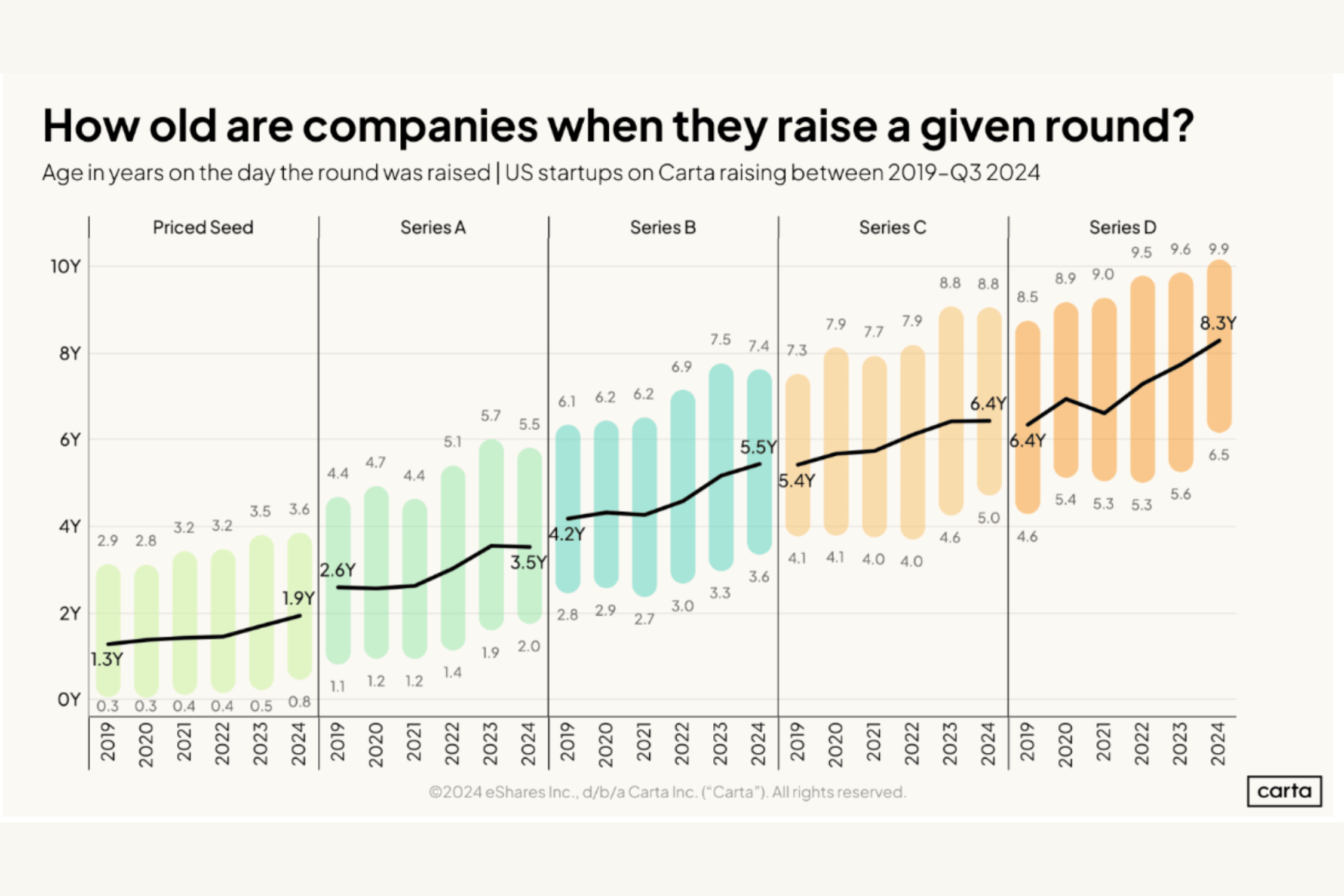

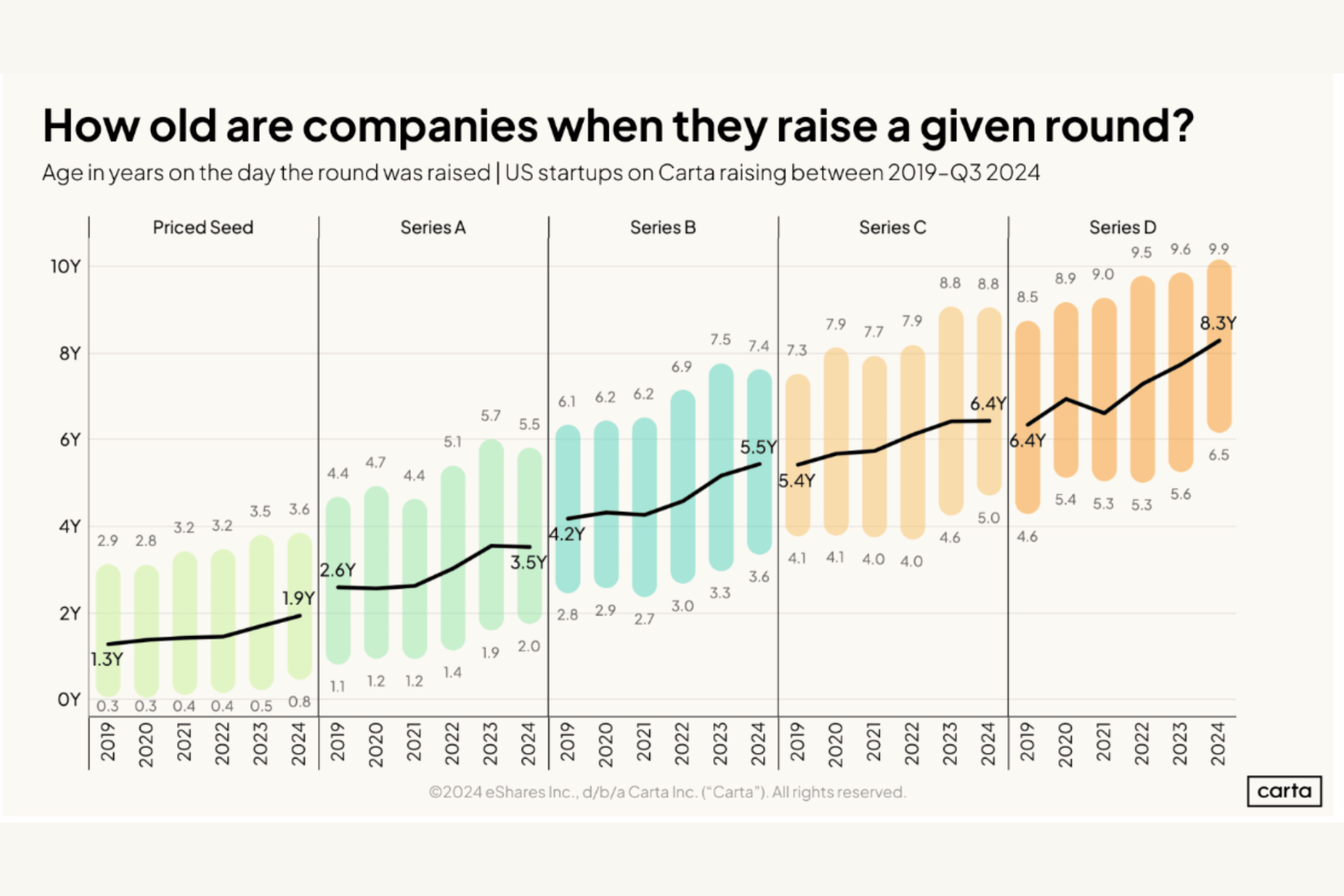

This recent chart from Carta caught my attention, specifically the increased time it's taking to raise Series A and Series B.

The median time to raise a Series A has increased from 1.3 to 1.6 years. On the high end of the bar, it's increased from 1.5 to nearly 2 years.

Meanwhile, the median time it takes to raise a Series B increased from 1.6 to 2 years, with the high end of the bar increasing to nearly 2 years as well.

This is a healthy change in these metrics. Let me explain why.

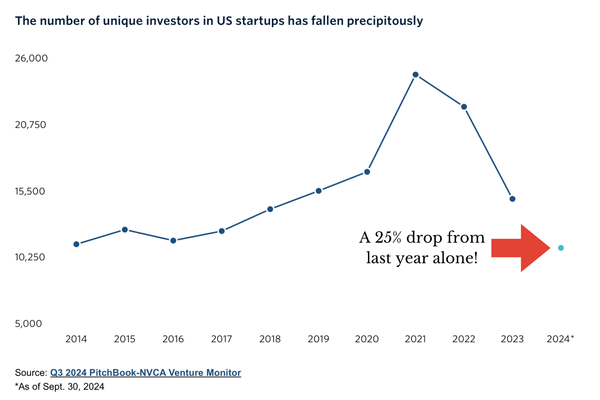

One reason the popping of the venture capital bubble has been so painful is that far too many startups didn't take the time to hit venture-scale milestones before raising their next round of funding. When the era of easy money was over, too many startups had raised too much too fast, and at valuations their metrics could no longer support.

Think about it. It typically takes at least six months to close a round of funding. Suppose you plan to raise a Series A only 18 months after your seed round. In that case, you are giving yourself only 12 months to hit Series A-level milestones before you pull together your pitch deck and start that first round of investor outreach.

For most startups, that is just not long enough.

Targeting a two-year window for your next fundraise gives you at least 18 months to hit those metrics. If you raise enough to give yourself 2.5 years of runway, you'll ensure you're startup isn't running on fumes as you close that next round, and plenty of wiggle room to pivot your way to product-market fit if things don't go as planned.

And as we know, things never go as planned.

While these are healthy changes in venture capital, that doesn't make it any easier for founders who are caught in the cross-winds of these shifts. But for founders who are raising now, we can learn from the mistakes of the past and build a startup that is more resilient to rapid changes in investor sentiment.