Time Is Killing Venture Returns

As an investment vehicle for LPs, venture capital is broken. As a founder, you need to understand this dynamic. Choose your investors wisely.

Venture capital has historically proven to be a poor investment vehicle for many limited partners ("LPs"), and the problem is only getting worse.

LPs invest in a venture fund expecting above-market returns in exchange for the higher risk of venture capital over the typical ten-year life of a fund.

A 15% annualized return is a typical target for VC funds, which implies approximately 4x cash distributions versus original investment in 10 years, excluding fees.

💡 This ratio is known as Distributed to Paid-In capital ("DPI"), the most important metric to an LP.

Note that two variables are critical to generating that rate of return. Cash distributions of at least 4x the original investment. Within a time frame of ten years.

A fund can fail to deliver that return in two ways.

First, the portfolio can fail to deliver adequate returns due to poor investments. At least half of all venture funds fail to return even 1x of invested capital.

But even if the fund distributes at least 4x invested capital, it can fail to deliver adequate returns to its investors.

How?

By taking longer than 10 years to deliver those returns. Look at what happens to the annualized return for every additional year it takes to get to 4x DPI.

➡️ 10 years - 15%

➡️ 11 years - 13.5%

➡️ 12 years - 12.3%

➡️ 13 years - 11.3%

➡️ 14 years - 10.4%

➡️ 15 years - 9.7%

Extending a fund to 15 years drops the average annual return of a 4.0x fund below 10% - a 35% reduction in returns while delivering the same multiple.

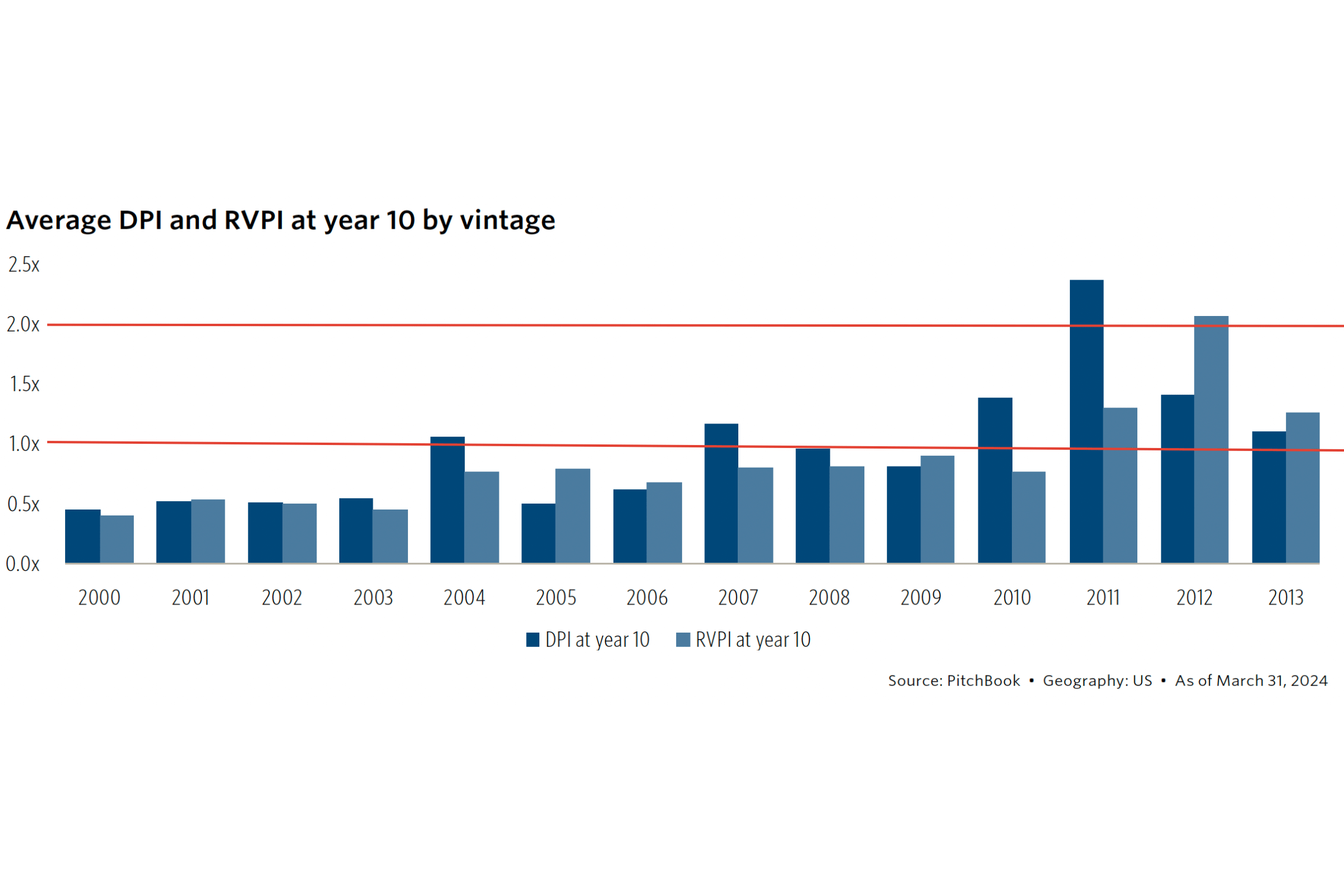

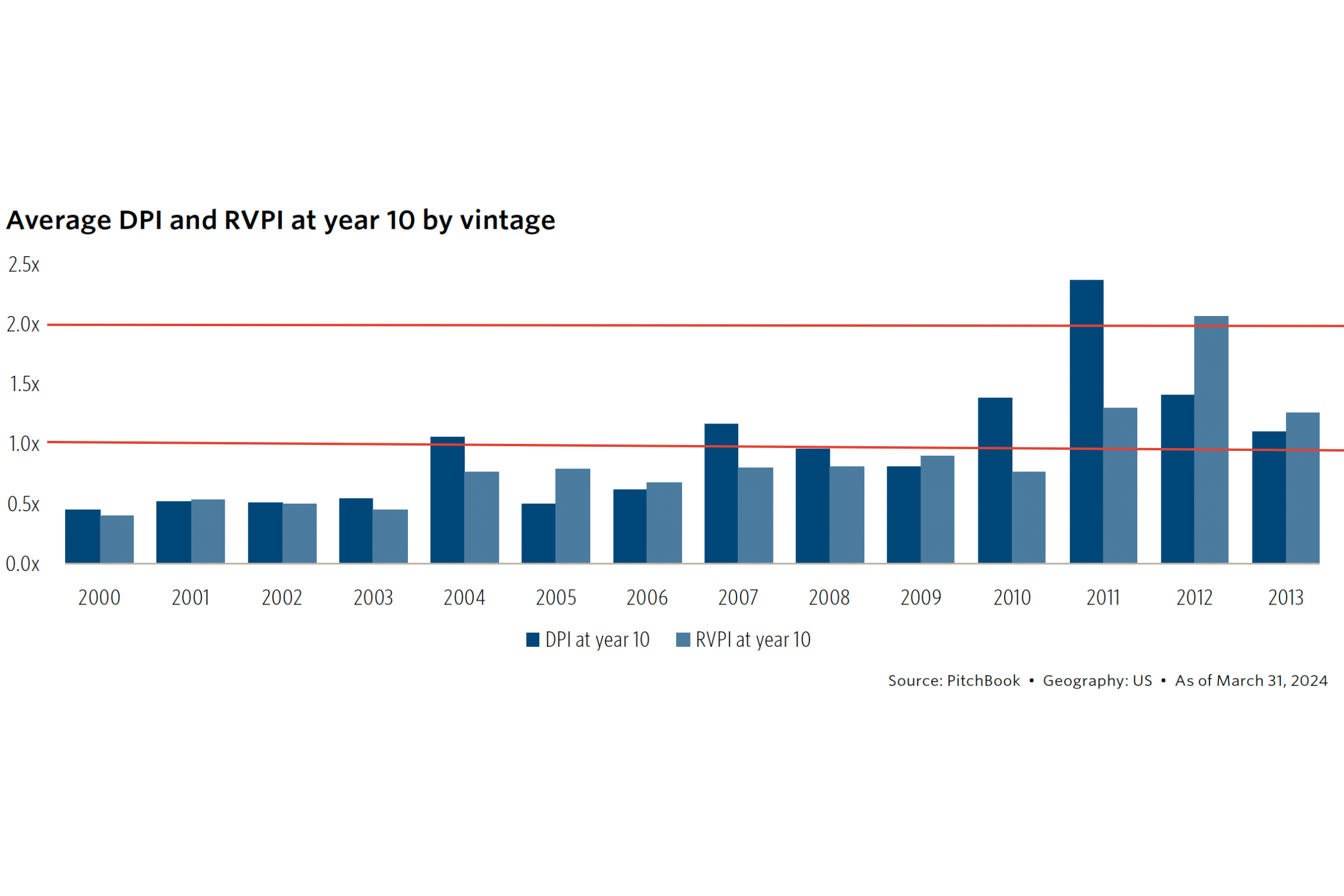

The chart below illustrates how few funds achieve even 1.0x DPI within the ten-year target.

We talked about DPI. The other ratio in this chart is Residual Value to Paid-in Capital ("RVPI"). This ratio reflects the remaining value of the investments the fund still holds.

💡 The two ratios together project a fund's potential return.

In only 6 years between 2000 and 2013 did funds realize an average DPI multiple of at least 1.0x by year 10.

And be wary of those inflated RVPIs. According to Pitchbook, 54.7% of US VC funds between 1996 and 2008 failed to distribute 100% of the fund’s remaining value at year 10 over the additional years granted by extensions. In other words, those RVPI projections were inflated, and given the venture bubble we just experienced, this trend will continue.

As an investment vehicle for LPs, venture capital is broken.

As a founder, understanding these dynamics is critical. Choose your investors wisely. Focus on funds with a track record of delivering timely returns to their LPs. While detailed DPI data isn’t always publicly available, you can still assess fund performance through other signals.

Look for funds that are transparent about their track record and approach to liquidity. Speak with other founders who have worked with these investors, particularly those who have successfully exited. Above all, aim to partner with investors who are known for managing their portfolios to align with founders’ long-term goals, creating value for everyone involved.