The Ripple Effects of SVB's Failure: Navigating the New Normal for Startup Funding

Stay in control of your startup. Stay focused on investing in profitable, scalable growth. Extend your runway as much as possible, staying default investable if possible, but always with a path to default alive.

In my last post, I covered the risk of a mass extinction event for startups in the next 12 months because of the pullback in venture capital investing. This risk is only higher with the recent failure of Silicon Valley Bank.

The ripple effects are just starting to reverberate across the banking industry. As Republic National Bank considers its strategic options and Credit Suisse gets its backstop from the Swiss central bank, the tightening of credit for startups is coming at an already difficult time for founders.

SVB's failure and the growing instability of the banking sector will result in fewer lending options for startups for two key reasons.

First, SVB was a pivotal partner to startups and has been an important part of the funding landscape for over 20 years. They understood the risky nature of startups. They nurtured relationships with the industry's most influential investors. They were willing to lend through flexible working capital lines of credit and venture debt with far more reasonable terms than many of their competitors.

Raise your hand if you breached a covenant on a Silicon Valley Bank debt facility, only to have them come back willing to renegotiate the terms and offer additional time and flexibility to work through your challenges. Yes, my hand is up too.

As credit tightens and banks consolidate, I don't know that we'll see another bank willing to step into this role with the level of enthusiasm and passion that SVB had for the space. Do bigger banks want this business? To the extent they are willing to lend to startups, we can be sure their debt facilities will be more expensive, with stronger covenants and far less wiggle room when you inevitably fall short of your forecasts.

Second, SVB's failure highlighted a serious gap in oversight and risk assessment across the banking industry. This creates the risk of a flight to larger banks, further weakening smaller banks. In addition, more regulation increases the squeeze on available credit to startups.

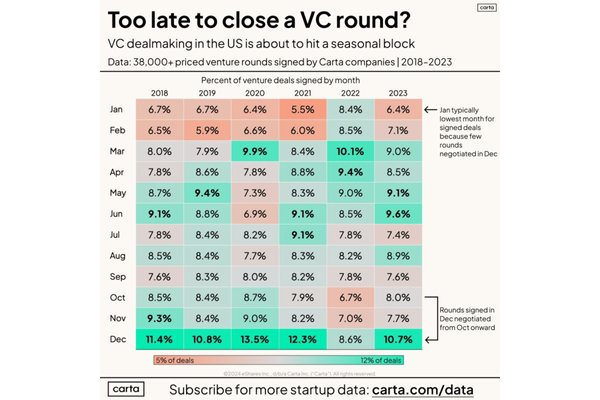

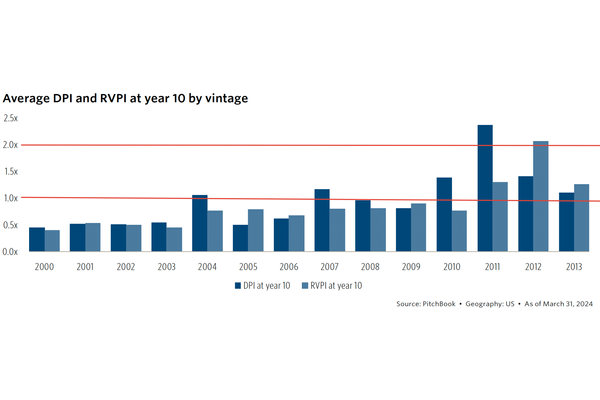

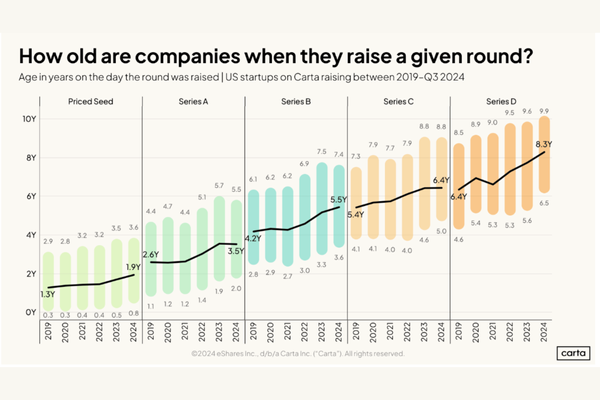

The combination of venture funding contraction and fewer debt options with more onerous terms will only accelerate the trends we were concerned about before SVB's failure. Longer periods of time between rounds of funding with fewer options to bridge that gap. Valuation compression and more investor-favorable terms when deals get done. More risk for startups as investors raise the bar for further funding.

So, what should you do?

Protect a stash of cash

It's impractical for most startups to split cash across many different banks to stay under that $250k FDIC insurance threshold. However, the federal support of SVB depositors suggests that if another larger bank fails and the government fears contagion, they will step in again to support depositors.

You should park 4-6 weeks of cash at another larger regional or national bank. Then, in the event of a disruption at your primary bank, you would have access to cash to weather the storm until the Fed steps in and releases your primary cash account. Sometimes that process can take longer than a weekend. This approach would have alleviated some panic founders felt last Friday when SVB failed.

Avoid smaller, local banks

The failure of SVB is a good reminder that banks do fail. 563 failed between 2001 through 2023, an average of 25 a year. Knowing that the Fed will likely support depositors of larger banks to avoid a broader bank run should steer you toward the larger regional and national banks. There is certainly safety in the largest, too-big-to-fail banks such as Chase and Bank of America. But you might find more support as a startup in the tier below these large national banks, with some comfort that your deposits will be protected in the worst-case scenario.

Create a debt facility with a separate lender

I've worked with many startups with a debt facility with a lender separate from the primary bank that holds most of their cash. Many specialized lenders can support your business, whether this is an accounts receivable line of credit or an asset-based facility supported by your inventory. In addition, diversifying your debt from your day-to-day treasury requirements creates more options if one partner fails.

Leave room on your debt facility

If you have a debt facility, don't run with that facility constantly maxed out. Instead, use your facility to manage your business's ebbs and flows of inventory, receivables, or seasonal variances. From now on, leave more room on that line, even at your highest level of need.

Last week, I talked to several founders that received commitments of financial support from their lenders based upon the availability of their facility that ensured they could make payroll and critical vendor payments if necessary. It was a crucial lifeline that was locked into place even before investors came forward with their commitments of support.

If you're running your startup with your debt facility consistently fully drawn, you need to take a step back and find a path to reduce your burn and better position your startup. This leads to my last suggestion.

Reassess your runway

I'm sure you have a plan for when you will raise your next round of funding. Managing the availability under your debt facility was a part of that plan. In light of the failure of SVB and the uncertainty it brings to the banking system, you need to reassess that runway. What happens if your lender cuts the size of your facility in half? What if you can't assume that your upcoming breach of covenants will be waved off? Is it possible that this instability in the banking system further weakens the economy, slowing growth? Or accelerates the pullback in VC investing, further extending time frames between rounds of funding.

Stay in control of your startup. Stay focused on investing in profitable, scalable growth. Extend your runway as much as possible, staying default investable if possible, but always with a path to default alive.