The Rapid Rise of Zombie VCs

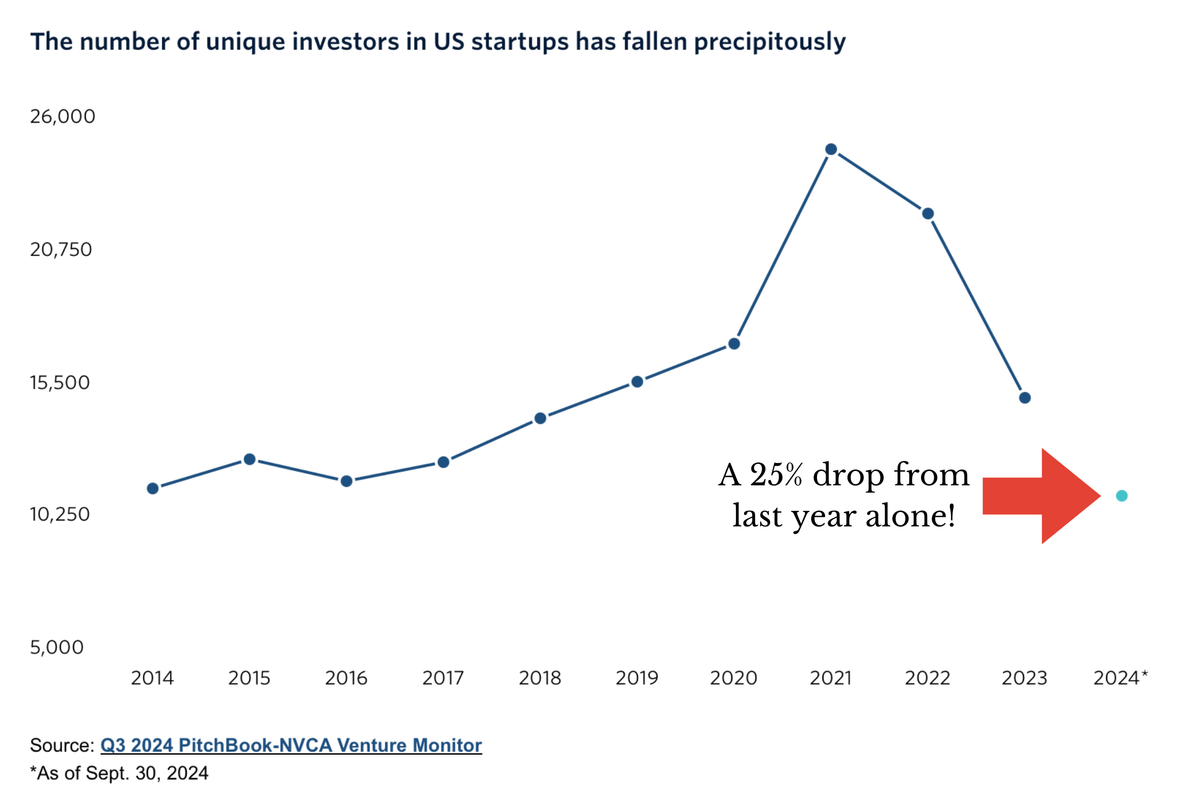

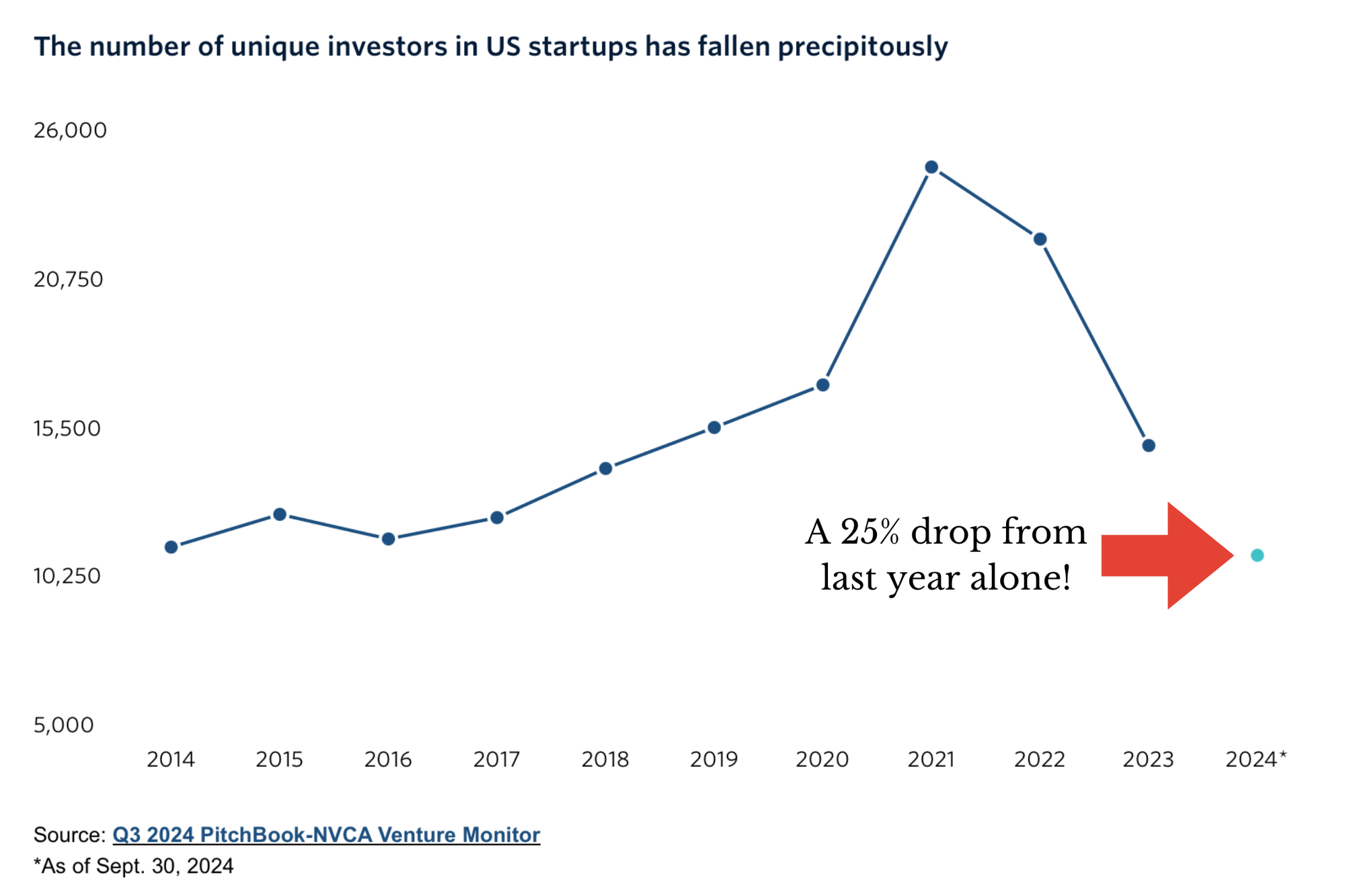

Zombie VCs are surging: 25% fewer active investors in 2024 vs 2023, and 50% down from 2021's peak. These funds can't make new investments, but their short-term focus can still cause major problems for founders in their portfolio.

The latest data from PitchBook highlights the surge of Zombie venture funds - funds that have fully invested their last fund but can't raise new capital for fresh investments. The number of unique investors in 2024 dropped by 25% from 2023 and more than 50% since the peak in 2021.

Zombie funds on your cap table, or even worse, on your board, can present complex challenges for a founder. Your incentives are no longer aligned. Zombie funds become very short-term focused, prioritizing winding down their funds and delivering distributions from their portfolio.

We are in a necessary correction after the venture bubble of 2021, but that doesn't make it any less painful. You should keep track of the investing activity of your largest investors to ensure you spot a potential Zombie fund early. This will allow you to work with your other investors and develop strategies that minimize the impact they can have on your startup's future.

Want a playbook for dealing with this situation? Read "How To Steer Your Startup Through The VC Shakeout."