Stay in Control

When it comes to the coverage of venture-backed startups, the topic of profitability isn't considered the most exciting angle.

Our obsession with unicorns, skyrocketing valuations, and shorter fundraise cycles ignores the fact that nearly ninety percent of venture-backed startups don't make it to their Series C and fail to find a path to an exit. Almost two-thirds of venture financings fail to return 1x of invested capital.

Underneath these statistics are individual founders struggling to save years of hard work. Perhaps we should focus on the path to profitability a bit more often.

Hockey stick growth in startup investments

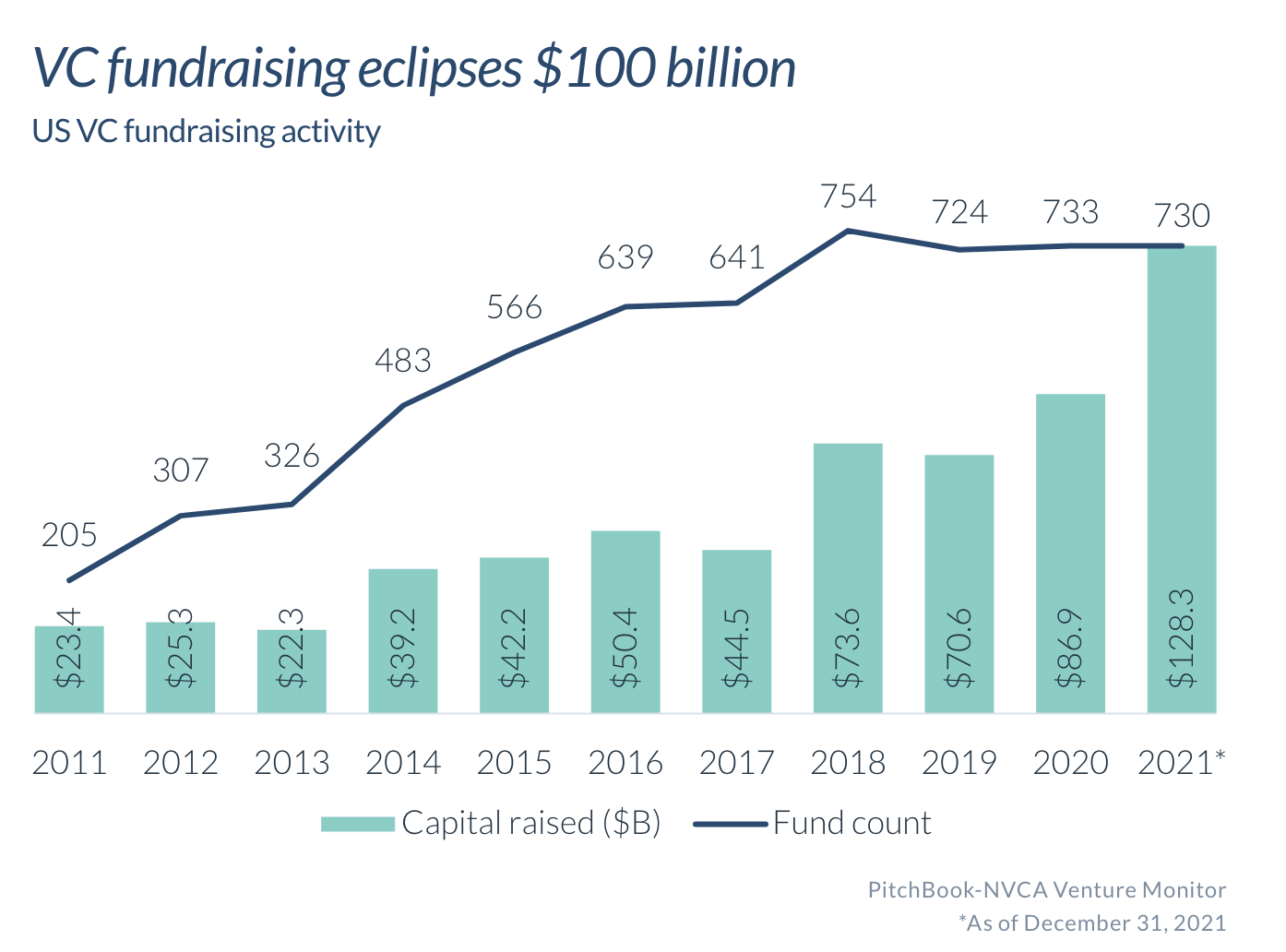

We have just been through an era of dramatic growth in venture capital. Over the last decade, the number of venture funds has increased 3.5x, from 205 to 730. The amount of cash raised by these funds increased by 5.5x, from $23 billion in 2011 to $128 billion in 2021.

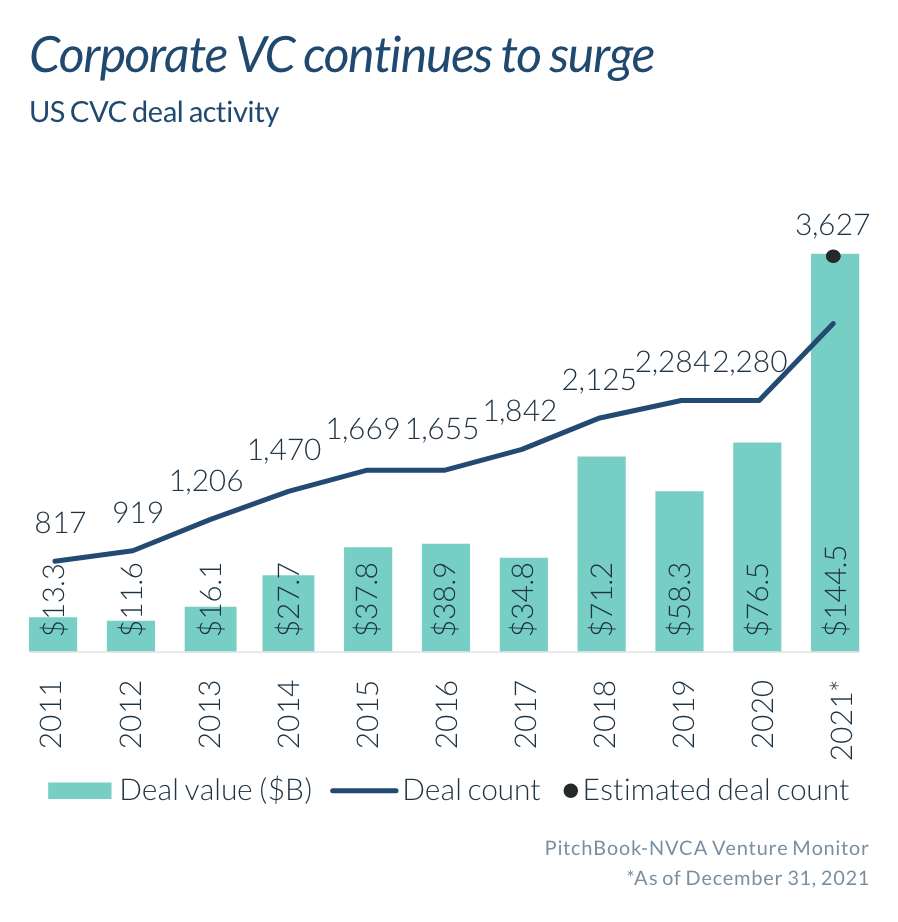

These growth rates don’t account for the similarly strong growth in nontraditional investor activity. For example, corporate VC surged from $13 billion in 2011 to $145 billion in 2021.

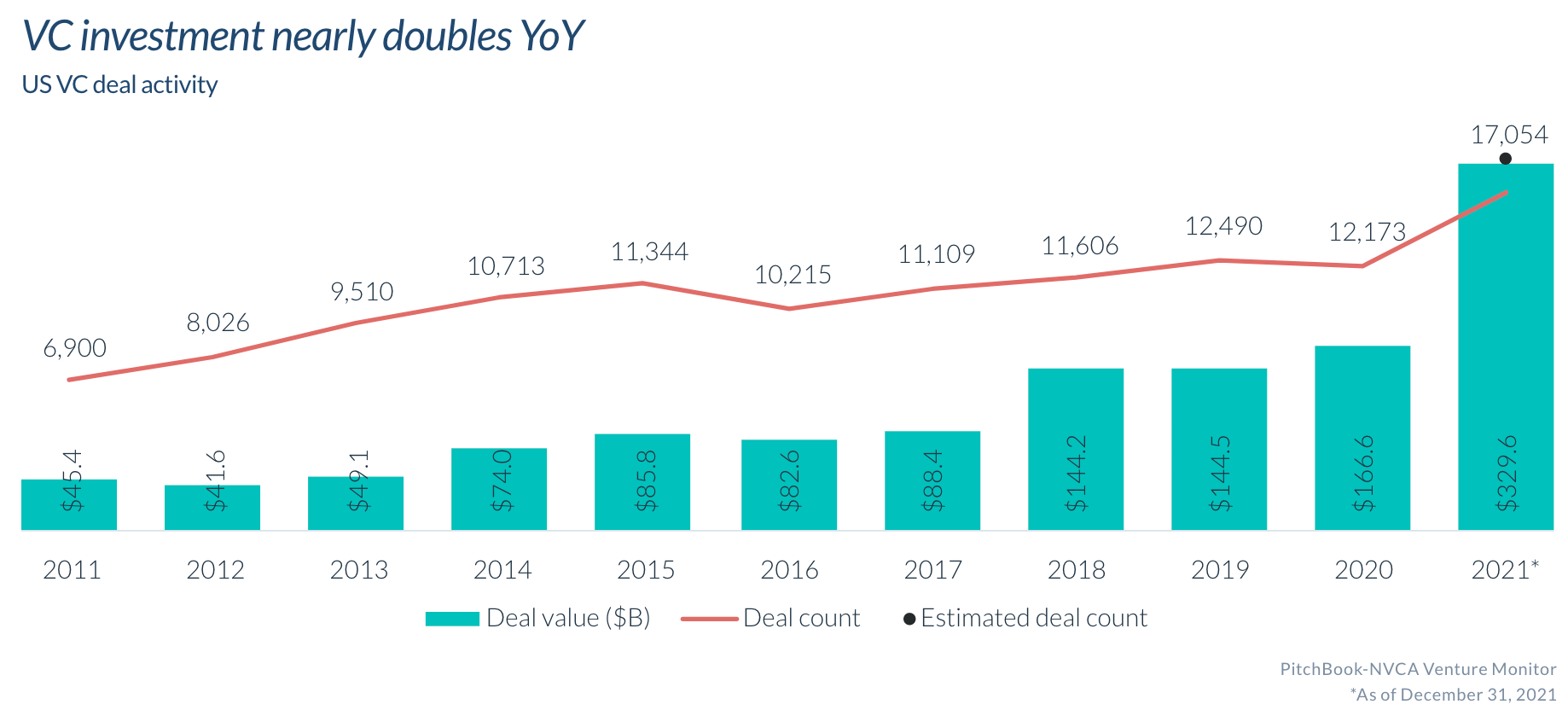

All of this cash needs to go somewhere. In 2021 we saw the total value of U.S. venture deals nearly double. This is a staggering data point, and it’s worth repeating. The amount of VC investment in 2021 nearly doubled in just one year.

The laws of supply and demand suggest that this dramatic increase in cash chasing a limited supply of truly venture-scale startups will create distortions in the marketplace.

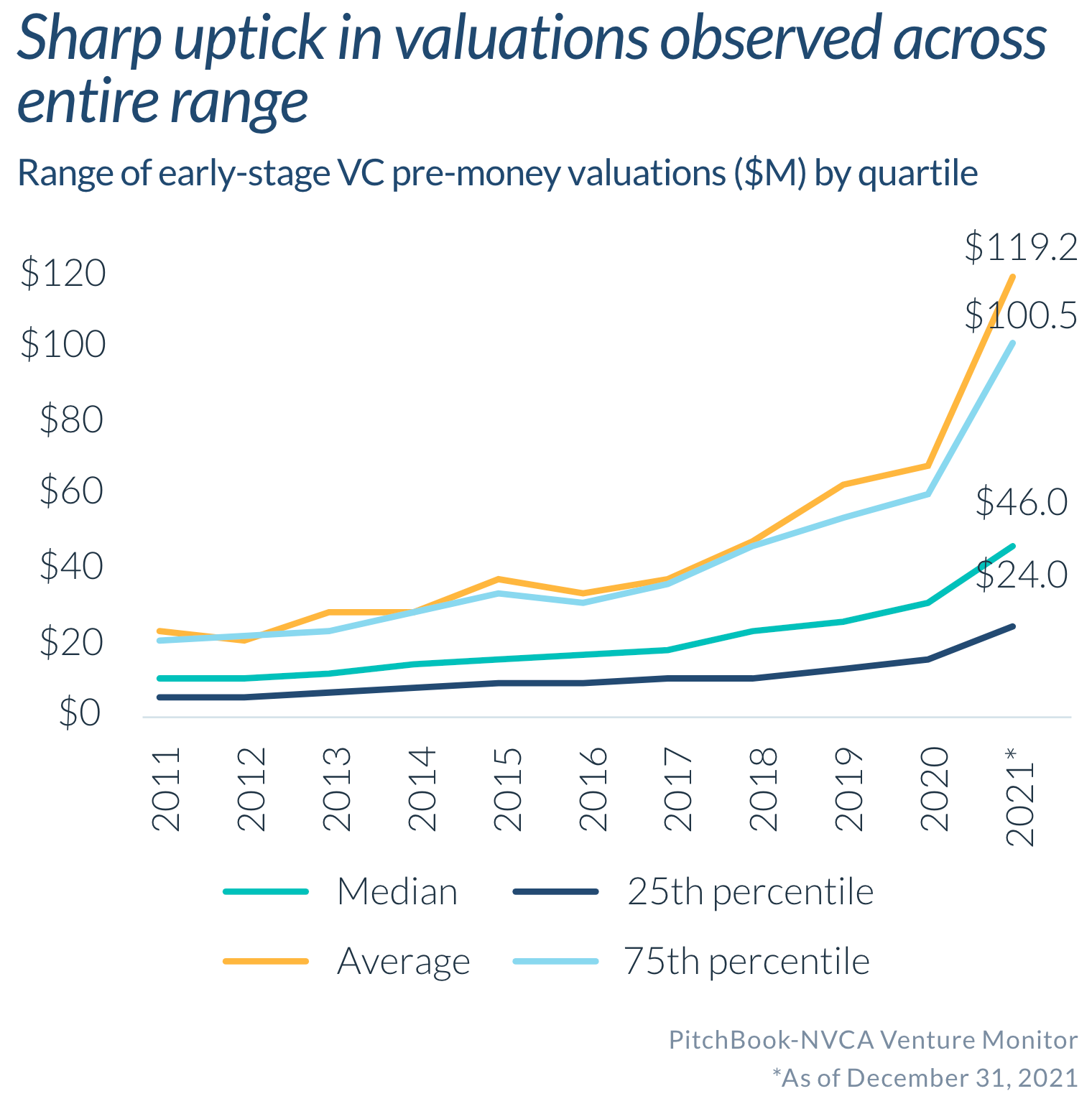

And it did. We saw a corresponding explosion in deal size and valuation. For example, median early-stage pre-money valuations and deal size doubled over five years. In 2021 alone, early-stage pre-money valuations increased by 53%!

Unprecedented Growth Fosters Bad Habits

With a seemingly endless supply of venture investment, and the time between funding rounds compressing, founders were encouraged to deploy freshly raised capital quickly. Focus on growth, get to the next fundraise and boost that valuation. Vanity metrics ruled the day.

The investors got their markup for their portfolios. The founder got a higher valuation, excited employees, and more cash for growth. The hamster wheel turned faster, and it was on to the next fundraise.

As a venture-backed founder, it can be tough to swim against the tide when everything around you seems to be going up and to the right. Even when you know your burn rate is too high, and your team is consistently missing key milestones. It is difficult to cut beloved projects or lay off employees when the macro story is strong. You're reluctant to make decisions that could be perceived as weakness, especially when you're reading another story about the next batch of unicorns or the successful funding rounds of other founders you know.

Investors and founders acted as if this trend would last forever. Now, the inevitable pullback is underway. We're about to see that many of those paper venture returns and ballooning valuations were an illusion.

For founders, this sudden turnaround will cause a tremendous amount of stress and existential risk to their startup. Many founders that were on track to raise their next round 6 months ago will find that they don't have the metrics or the cash to wait another year or more to raise again.

That higher-than-expected valuation from your last round is a hurdle you now have to jump over. Or crawl under.

For many founders, the pullback in VC we are experiencing is the first real crisis they face. The coming months will be challenging. But a crisis also makes us more receptive to considering alternative approaches to building a venture-backed startup that may have been disregarded in the past. When founders might consider a different path to growth that can produce better results while lowering the risk of a complete wipeout if things don't go as planned.

Now We Can Talk About the Pivot to Profitability

The challenges founders will face during this market pullback are not unique to this moment in time.

Venture-backed startups have consistently suffered from a Blitzscale mentality, taking an all-or-nothing approach to raising and deploying venture capital. This approach to growth hasn't been discouraged by VCs, who build portfolios of startups with the expectation of high failure rates in the search for one or two home runs that can deliver the outsized returns their LPs expect.

Over the past five years, the tidal wave of investor cash has only accelerated the trend.

I started writing and presenting the Pivot to Profitability in 2019. It was difficult for the message to break through in such an exuberant market. Timing is everything.

This is an opportunity to rethink how we grow VC-backed startups. It's not an anti-VC framework. The Pivot to Profitability is a shift in mindset. You push aside the focus on vanity metrics that support growth at all costs. You resist the pressure to sprint to your next fundraise before you're ready. You don't accelerate your investment in products and initiatives that don't work, wasting precious runway.

Instead, you methodically build a solid, growing foundation of product-market fit that will support profitable, scalable growth. Once you find product-market fit, you build up enough runway to always have a path to cash flow positive.

As Paul Graham defined it, you shift from Default Dead to Default Alive.

The Pivot to Profitability gives you leverage in funding or M&A discussions. It's a path to self-sufficiency when suddenly your startup is no longer in fashion with investors. Or when you realize you can't deliver the kind of venture returns investors seek. It's a framework for navigating difficult discussions with your Board and investors when things don't go as planned.

The Pivot to Profitability puts the founder back in control of their destiny. In this newsletter, we'll explore how it works and how to make it a part of your startup journey.