Scaling Product-Market Fit is a Marathon, Not a Sprint

Product-market fit is widely misunderstood. The concept is often interpreted as suggesting a binary outcome. As if once you've checked off the product-market fit box, all you need is enough venture capital to grow your way to a successful outcome.

The reality is far more complex.

Growth - Viable = Danger

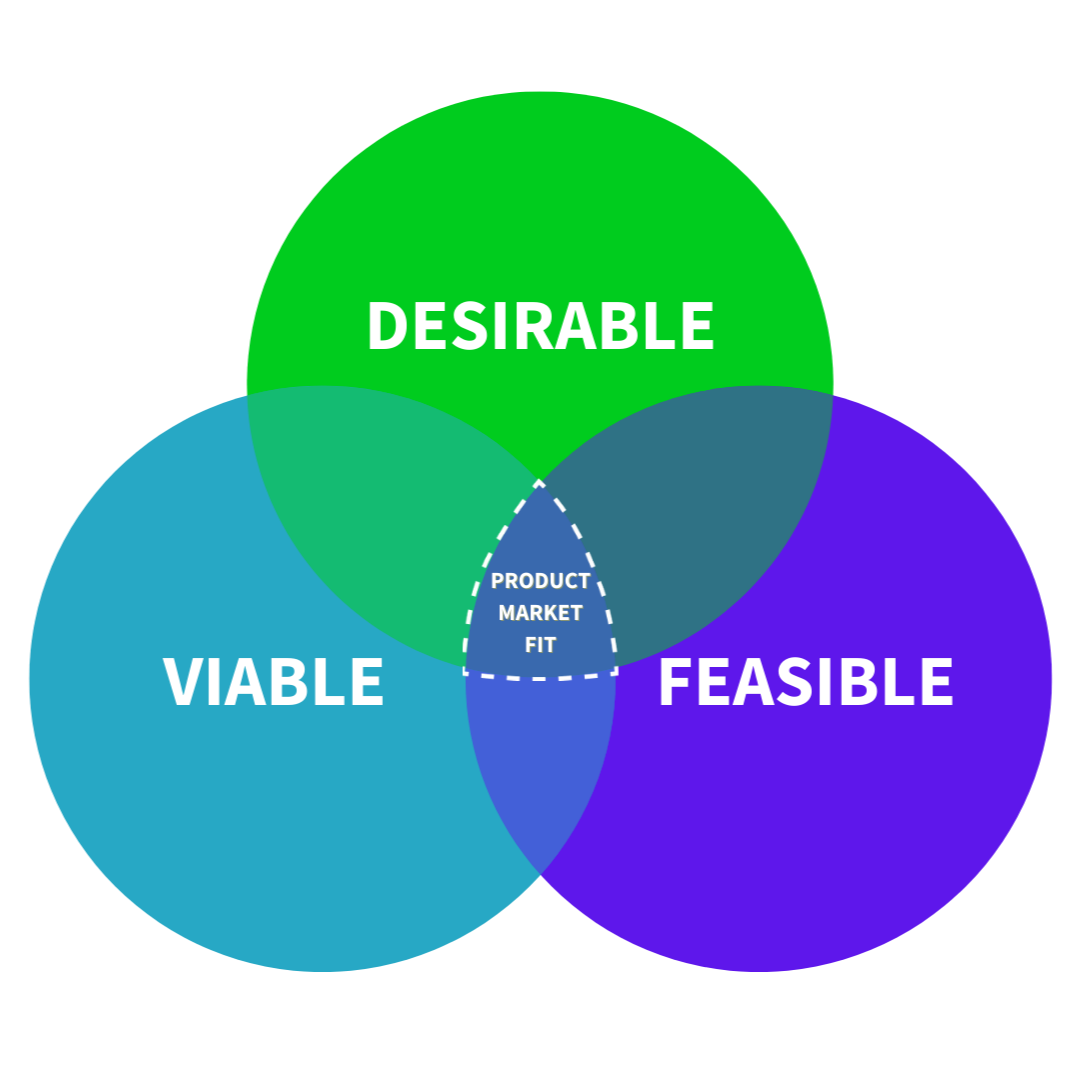

Product-market fit is found at the intersection of feasible, desirable, and viable.

- Feasible: Given your limited time and resources, can you create the product or service for the problem you are trying to solve?

- Desirable: Is there a sufficiently large market?

- Viable: Is there a business model that can sustain a profitable company that generates positive cash flow?

Scaling is another important concept that is often confused with growth. Pour enough cash onto most ideas, and you can generate growth. You are scaling your startup when you can grow sales without a corresponding increase in expenses. This is the path to profitability and positive cash flow.

In the sprint to the next fundraise, testing for viability in product-market fit is often overlooked. Growth is confused with scaling. This is a dangerous combination.

The Challenge of Scaling Product-Market Fit

We know that finding and scaling product-market fit is hard work. Startups are laboratories, spinning up various experiments to find new paths to customers and growth.

In the search for new customers, you increase spending on sales and marketing. You launch new products and services, hoping to extract more value from existing customers while also unlocking new customer segments.

You know that all of this growth work is fraught with peril. Many of the things you try won't work. New products may not be as desirable or viable as your original idea. Marketing channels don't scale infinitely at your target efficiency. New sales channels can prove to be inefficient paths to new customers.

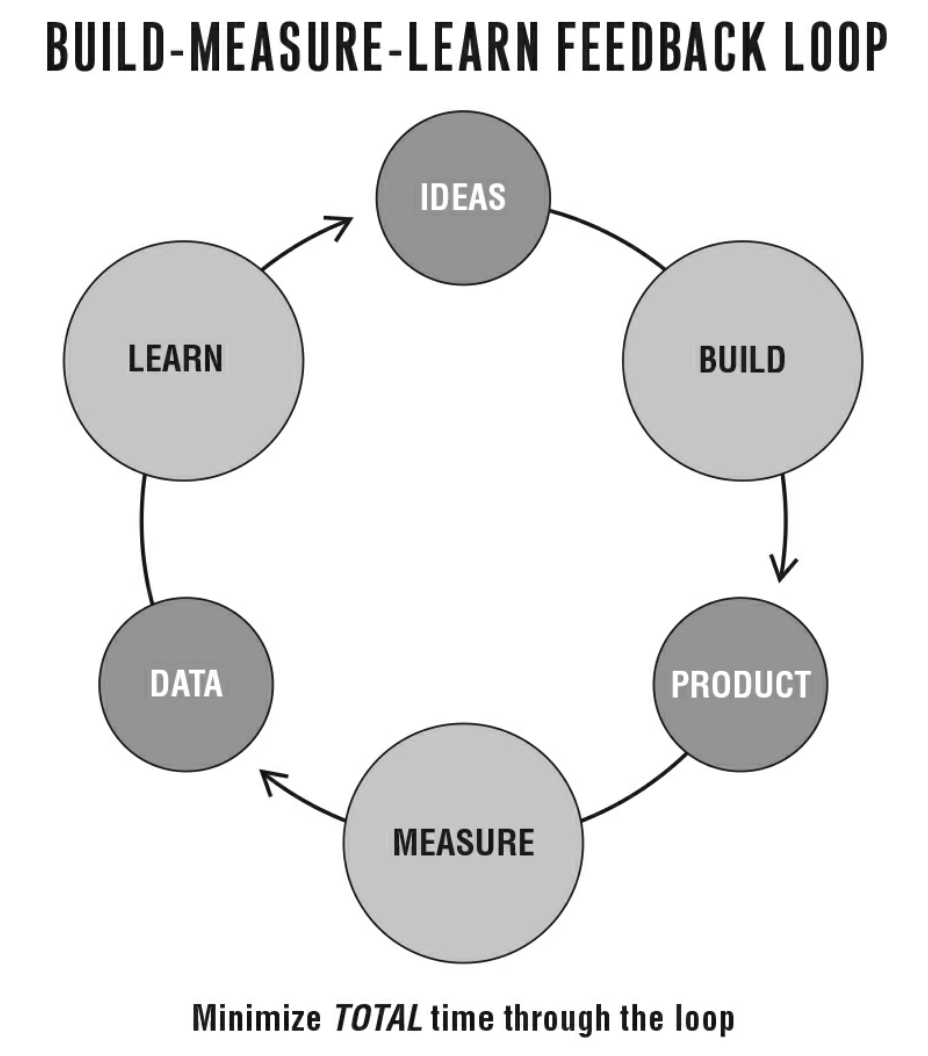

This is why growth must be built on a constant cycle of testing, measurement, and iteration. In his essential book, The Lean Startup, Eric Ries defined this process as the Build-Measure-Learn Feedback Loop.

This methodical approach to growth is crucial to ensure that you don't waste precious time and money on efforts that won't scale.

The Pressure to Sprint to Your Next Fundraise

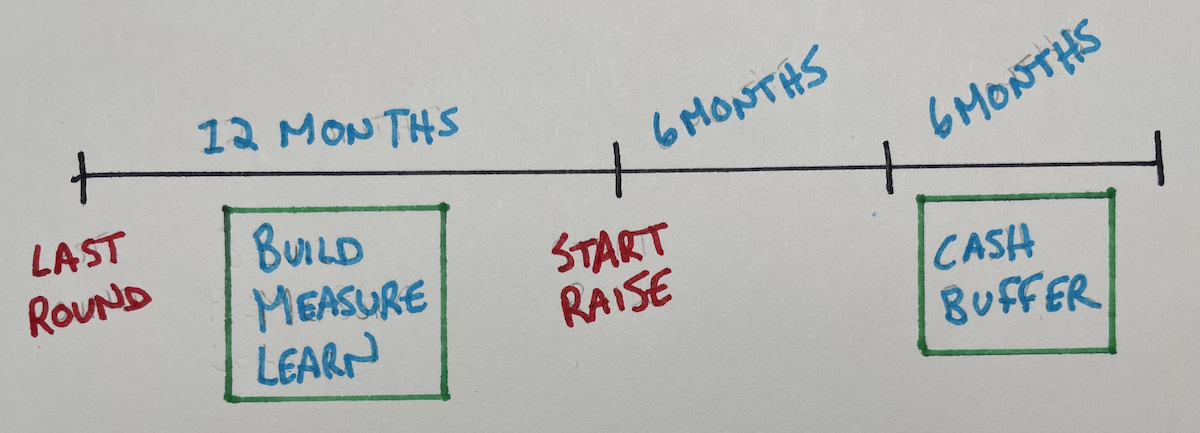

Historically, the median time between early-stage funding rounds is less than 20 months. This aligns with the common advice that you should raise 18-24 months of runway.

Why is this a problem? Doesn't nearly two years between rounds of funding sound like plenty of time?

Maybe not. Let's assume that you want to give yourself six months to complete your next fundraise. That's six months from the moment you start reaching out to investors until the cash hits your bank account. I know you think you can close that round in less than six months. But, consider the possibility that potential investors disagree.

You should add a six-month cash runway buffer, which ensures that you aren't trying to close a round of funding while your startup is running on fumes. This buffer also serves as a safety net if your fundraise doesn't go as planned. I speak from experience when I say that most don't go as planned.

Between the time for the process and your buffer, you want 12 months of cash runway in your bank account at the start of your next fundraise. Which only gives you twelve months to deliver the growth and KPIs you need before launching that process.

For many startups, this isn't enough time. The day after you close your last round of funding, you find yourself in a twelve-month sprint.

The Combination of Too Little Time and Too Much Money

Many startups fail because they bury product-market fit under a pile of wasteful initiatives in a desperate attempt to grow too fast.

It doesn't help that over the past decade, the average early-stage deal size increased by 3.5x while valuations increased by over 4.5x. The combination of more cash, higher valuations, and compressed timeframes between funding rounds puts your startup in jeopardy.

Add to this dynamic a media environment where the coverage of startups focuses on the booms and busts, with very little coverage of the day-to-day grind of startup life. It all adds an extraordinary amount of pressure on founders to deploy their last round of funding as quickly as possible, throwing spaghetti against the wall and hoping that something sticks.

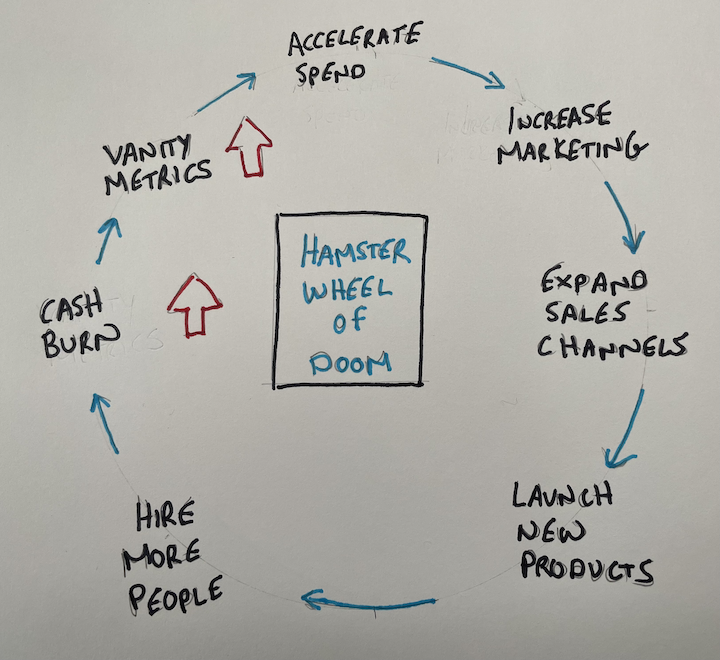

Your cash burn starts to accelerate faster than you had modeled. As a result, your runway is getting shorter. Something is wrong, but you don't know exactly what. Instead of pulling back on spend and slowing growth, you spin the hamster wheel faster to keep sales growth strong enough to get to your next fundraise.

The Build-Measure-Learn feedback loop we discussed earlier? There isn't much time for that kind of rigor. There are too many different initiatives to measure. Your rapidly growing team is busy hiring and onboarding. They haven't built the processes to properly track the results of their work. You don't have all of the reporting and measurement tools in place.

Some startups successfully claw their way through to the next fundraise. But given that 90% of venture-backed startups don't make it to their Series C or find a path to an exit, it's safe to say that eventually, this cycle will catch up with you.

How to Avoid This Trap

Don’t Chase Growth

I know you have that chart in your last pitch deck showing revenue going up and to the right. If that's your only measure of success, you risk driving your startup right off a cliff. You must be prepared to slow the pace of growth, or even get smaller, if that's what it takes to extend your runway and give your team more time to find a path to more scalable growth.

Great startups take far longer to build than most founders expect. You do not have to squeeze your startup into the typical 18-24 month fundraise cycle. Instead, give you and your team time to lock in product-market fit. Test your way into scalable growth. Don't limp into your next fundraise on fumes, burning too much cash with underwhelming KPIs. At best, you'll end up with lousy deal terms. At worst, you won't be able to raise at all.

How do you give yourself more time?

Do Fewer Things Better

Two things that I know are true:

First, you can't manage what you don't measure. Don't allow your team to spin up new growth initiatives that they don't have the time to track properly. Every initiative should have clear target KPIs that define success, agreed-upon timelines by which that success must be reached, and a direct connection to the milestones you need to achieve.

Second, you must encourage experimentation, allow for failure, and demand the shut down of projects that fall short of expectations. Startups are laboratories. You're supposed to be constantly running growth experiments. Unfortunately, most of the things you try won't work as well as you had hoped. Too many startups get in trouble because they don't pull the plug on cash and time-draining initiatives. This will kill your startup. You must instill this discipline on your team and be relentless in rooting out resource-wasting efforts before it's too late.

I know. Don't chase growth. Do fewer things better. Easier said than done. But these are the tools that keep you in control of your own destiny. Don't worry. We've barely scratched the surface of these topics. In future issues of the newsletter, we'll dig in further.