Inflation and Recession Are Coming For Your Contribution Margin! Here’s What You Need To Do.

We're in a tricky time in the economy.

Inflation is the highest it's been in decades. Your costs continue a relentless march upward.

In response, governments are raising interest rates to slow down their economies and reduce demand. Businesses and consumers, feeling the pinch of inflation and concerned about a possible recession, are pulling back on spending and looking for deals.

Higher costs and pressure on your pricing. This is the perfect opportunity to talk about contribution margins.

What is Contribution Margin?

Contribution margin is a way to measure the unit economics of your business product by product.

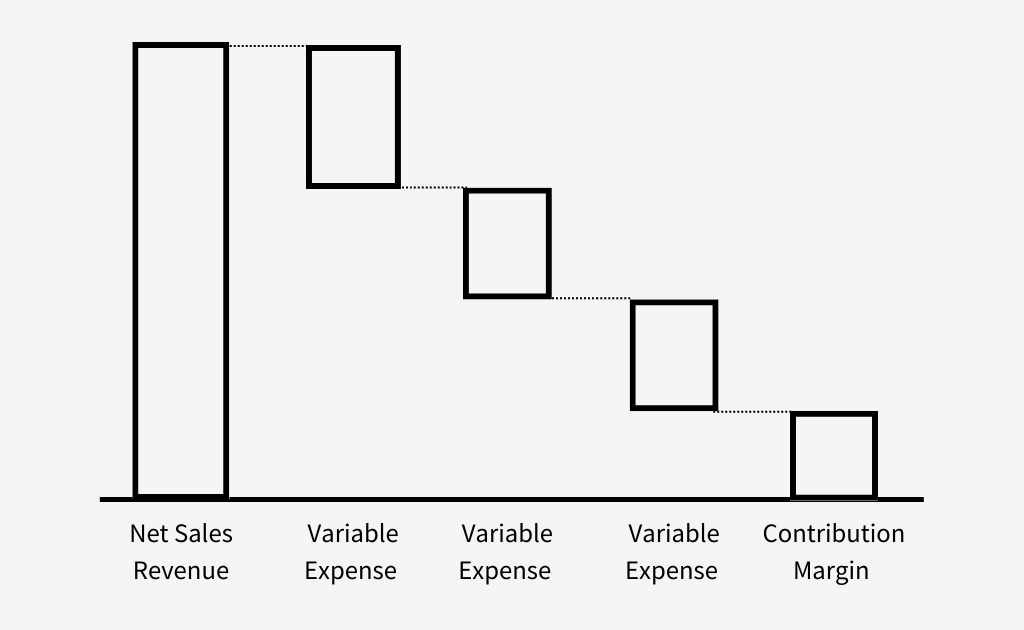

Contribution margin is calculated as the net unit sales price minus unit variable costs required to produce and sell a product.

Your net sales price should reflect the impact of discounts and promotions you've been using to maintain your current sales level. As the economy slows down, your use of discounts and promotions likely increases, lowering your net unit sales price.

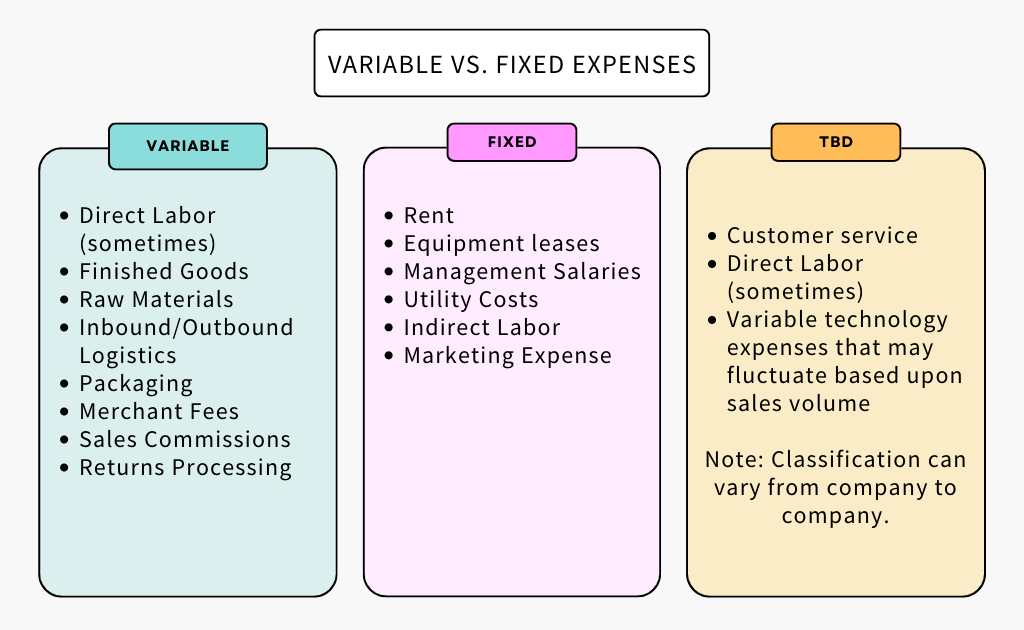

Meanwhile, unit variable costs are specific to producing and selling one unit of a product or service. Classifying whether expenses are variable or fixed can get complicated, and it's where most mistakes are made in this calculation.

You Can't Manage What You Don't Measure

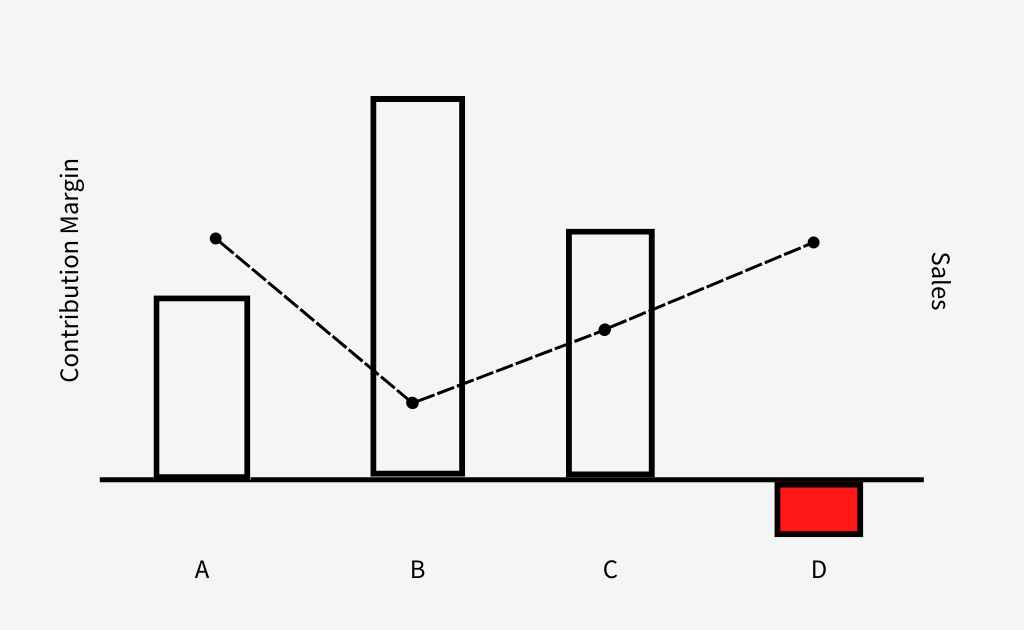

As a first step, take the time to calculate the contribution margin of every product or service you offer.

Chart your findings, providing a visual way to quickly see the trends, strengths and weaknesses of your current offering. Add a line to indicate sales volume to complete the picture.

Get That Contribution Margin Back Up

Now that you've calculated the contribution margin for each product, you can take two steps to improve your startup's profitability and cash flow profile.

Raise prices and reduce discounts.

I'm still surprised at the number of founders I meet who have weathered more than a year of rapidly rising costs without raising prices while wondering how they can improve profitability and reduce cash burn.

This is a symptom of trying to chase growth at all costs.

There is no escaping the simple math of the contribution margin. If costs go up and prices remain flat, your margins will fall.

Raise the prices of your most loved products and get those contributions back in line with your original targets. (We'll deal with the pricing strategy of those less beloved products in a moment.)

Reduce Variable Costs

You may be able to unlock quick wins in your effort to reduce variable costs.

Simplify your packaging. As the shipping logjam continues to loosen, shift back from air to sea to lower the cost of inbound shipping. Raise the order value your customers must reach to earn free shipping. Charge restocking fees to offset the cost of returns.

As demand softens, some suppliers might be willing to negotiate better rates to maintain volume. Particularly those that were ramping up charges over the past few years to take advantage of a spike in demand.

You can also lay the groundwork for longer-term changes that can bring higher contribution margins in the future. Moving to a new 3PL. Incorporating automation to reduce labor costs. Redesigning products to incorporate lower-cost raw materials.

But when time is of the essence, find those quick wins wherever you can.

Take Action: Time for Tough Decisions

You've raised prices where you could. You cut variable costs as much as possible for now. Once you've assessed these changes' impact on each product's contribution margin, you have important decisions to make.

High contribution margin products

Lean in. This is where you should be focusing most of your resources. Marketing, product development, customer experience. Drive volume and power a higher gross margin.

Low contribution margin products

These products require more analysis. Some low-margin products can be cash cows. They require little to no investment in marketing and product development while delivering consistent sales and profit. Cash cows are great.

Other low contribution margin products are a net negative to your business because they require far too much investment of time and money to support and a high level of marketing to maintain sales volumes. Group these products with your negative contribution margin products as you make final decisions.

Negative contribution margin products

The old saying, We lose money on every sale, but we'll make it up in volume." That's a joke, not a strategy.

Negative contribution margin products have to go.

You're diverting resources from higher potential products. You are burning cash with every sale.

The vanity metric of gross sales might entice you to keep them. But you're not chasing growth at all costs anymore.

This is where you can use aggressive discounting to clear these products from your inventory, turning them back into cash while protecting the pricing power of your more valuable products.

Going Deeper

The contribution margin analysis can be further broken down by sales channel, allowing you to account for the differences in variable costs. You can also look at the unit economics of a customer by sales channel to compare the estimated lifetime value of a customer to customer acquisition costs. We'll explore these topics further in future issues of the newsletter.