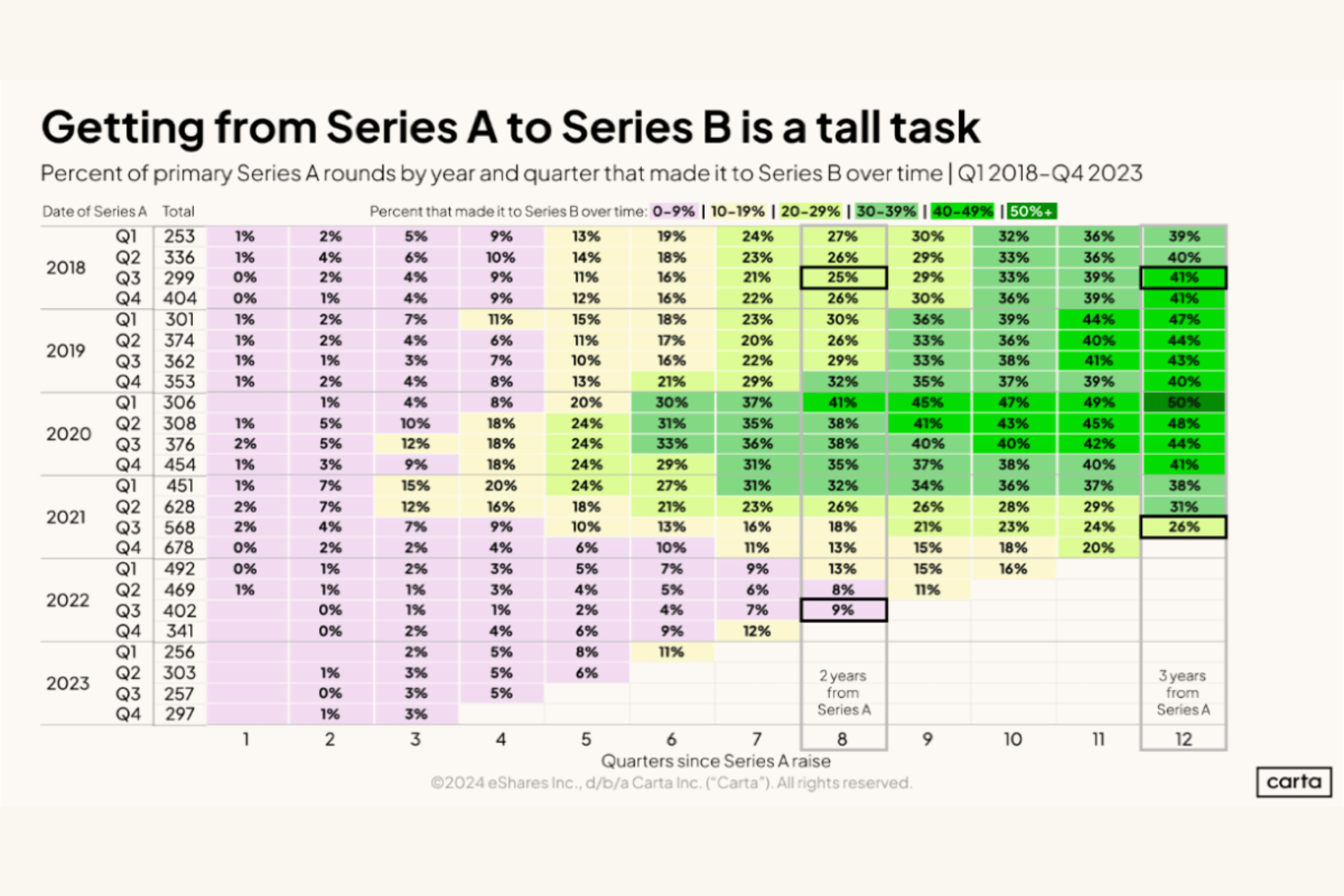

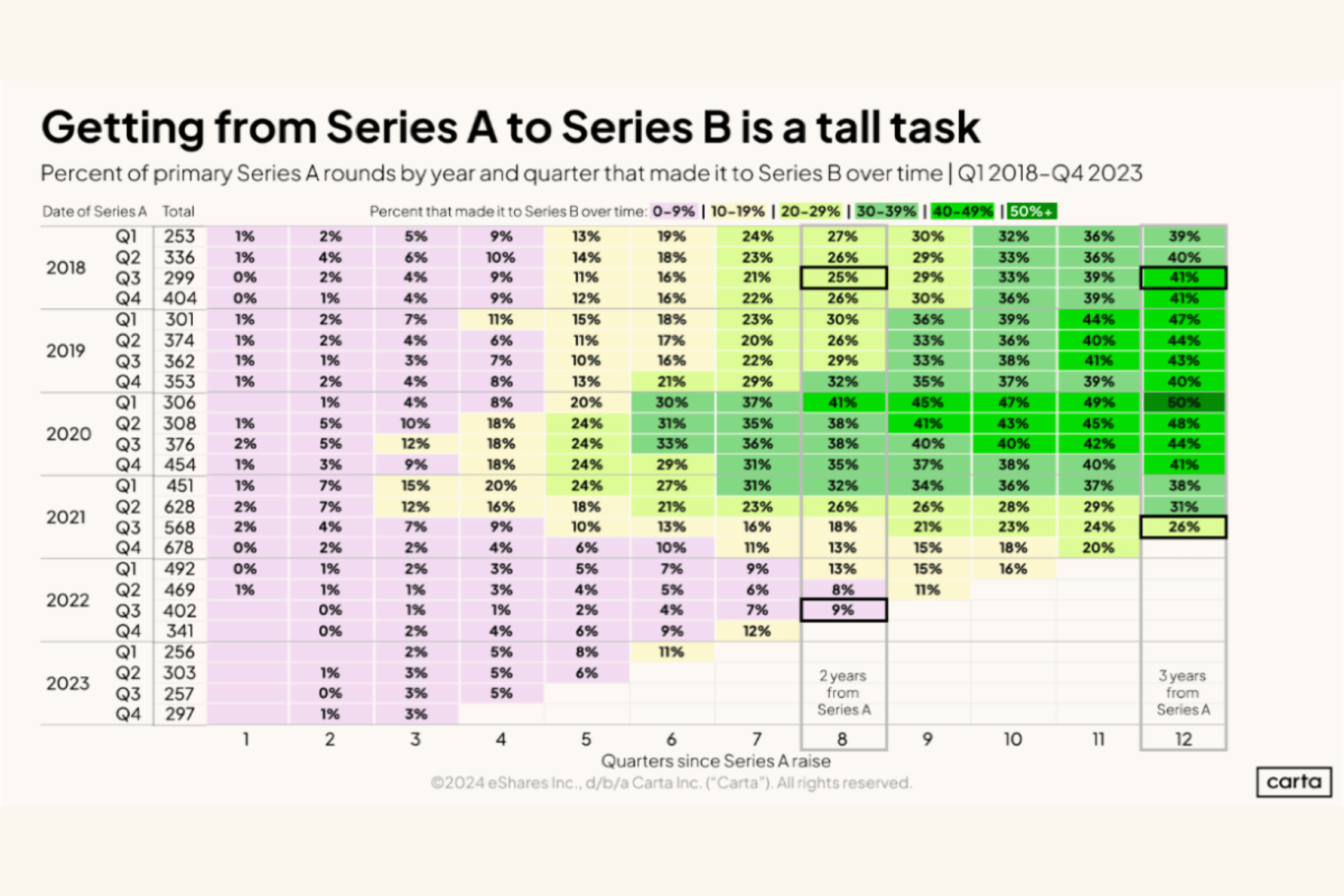

Getting from Series A to Series B is a Tall Task

This chart tells an important story for early-stage founders. Only 10% of startups that raised a Series A in 2022 have raised a Series B two years later. That drop of nearly 2/3 from 2018 represents a brutal cliff for founders.

This chart from Carta tells two important stories for early-stage founders trying to stay on track to raise a future growth round.

Take a look at the top of the chart. 28% of startups that raised a Series A in 2018 - 2019 successfully raised a Series B within two years. That number rose to only 42% after three years.

The rest of those startups either pivoted to profitability, were acquired, or ran out of cash.

This is between 2020 and 2022 when venture capital was entering a bubble, and startups had the easiest access to cash we’ve seen in a generation.

Now, look at what happens when that bubble pops.

Only 10% of startups that raised a Series A in 2022 have raised a Series B two years later. That drop of nearly 2/3 represents a brutal cliff for founders to navigate.

If you’re a founder who raised in 2021 or 2022 and struggling to raise your next round, you should be aware of these strong headwinds.

If you’re hitting venture-scale milestones, perhaps you need to reset your valuation expectations or deal with an unwieldy preference stack on your cap table to get new investors on board.

If you’re not hitting venture-scale milestones, the current state of venture will show your startup no mercy. Find a different path.

Pivot to profitability, find non-venture sources of funding, or start working on an M&A track that might at least produce a soft landing for you, your team, and your product.

Don't hope the tides will turn in venture capital. They won't in the foreseeable future. And hope is not a strategy.