Down Round, Cram Down, or Wind Down. Difficult Decisions Ahead.

In the first few issues of this newsletter, we've talked about the importance of thoughtfully scaling product-market fit, choosing your investors carefully, and the impact external events can have on your startup's ability to achieve its goals.

Let's tie those concepts together within the context of the current funding environment.

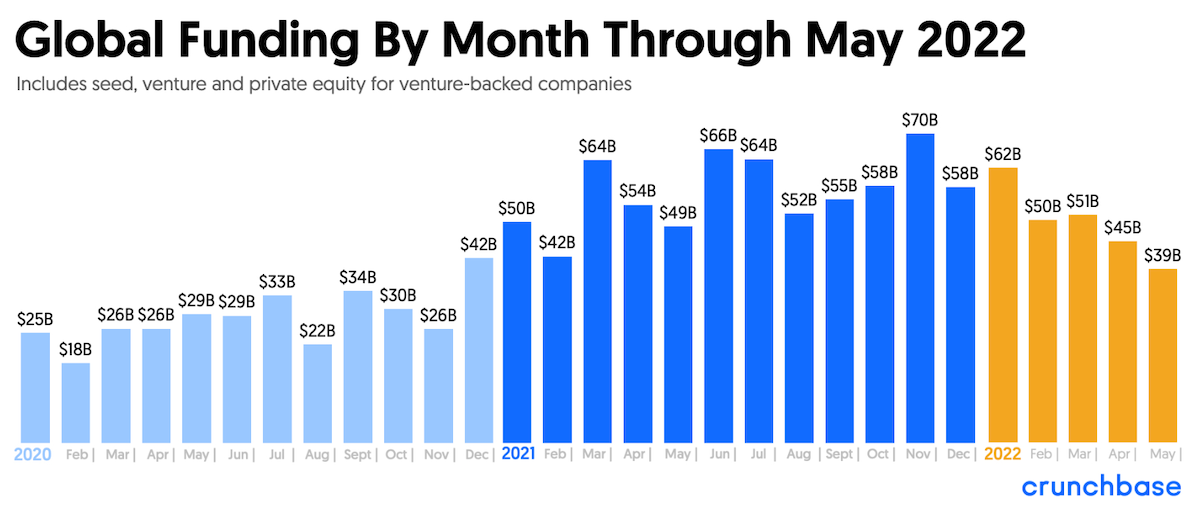

From Crunchbase:

Global venture funding in May 2022 reached $39 billion, marking the first month in more than a year when it dropped below $40 billion. The May figure is also well below the $70 billion peak VC funding reached in November 2021.

VC funding in May fell 14% month over month from $45 billion in April. The largest pullback was in late-stage venture capital, which fell from 2021 monthly averages by close to 40%.

My crystal ball doesn't see very far into the future. No one knows how steep or prolonged this pullback might be. For startups running low on runway, it doesn't matter. As valuations compress, founders who must raise capital in the coming months must learn not to fear the down round.

Instacart Led The Way

In March, Instacart announced that it was slashing its valuation by nearly 40% to $24 billion. The grocery-delivery startup had been valued at $39 billion only a year earlier. So why would Instacart cut its own valuation? It wasn't trying to raise more money. Investors weren't pressuring management.

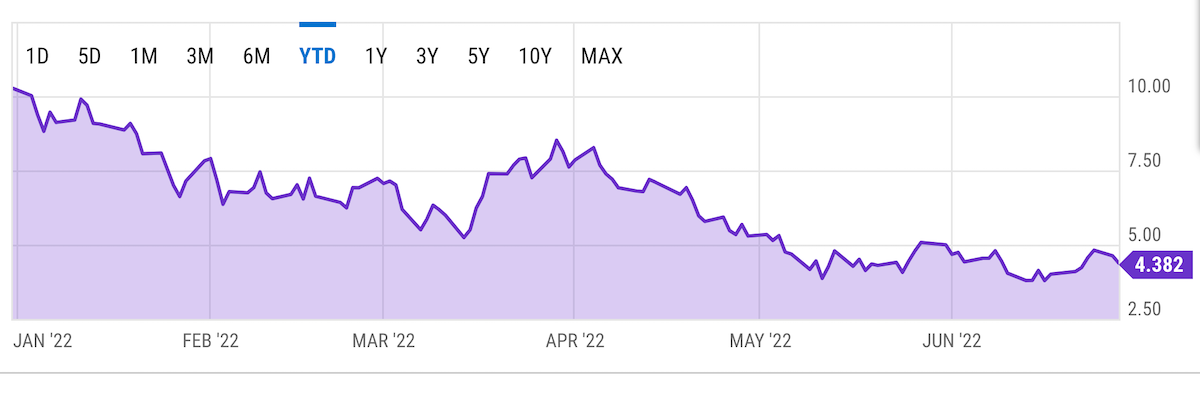

There is a clue in the YTD price/sales ratio chart for DoorDash, a publicly-traded competitor. The price/sales ratio represents the revenue multiple for a particular company, similar to the sales multiple that drives most early-stage valuations.

As discussed last week, this multiple can expand dramatically in boom times, signaling investors' willingness to pay more for a dollar of sales. When we hit a pullback in the economy, these multiples contract, lowering public company market caps and private company valuations.

Instacart filed a draft registration statement with the SEC in early May for a potential IPO. And that filing clarifies why Instacart took that valuation hit in March. In DoorDash's price/sales ratio, Instacart saw the valuation compression impacting their sector. So they realized that it was better to take the pain of a valuation cut in private, well before the filing for an IPO, than to try to chase an unrealistic valuation in the public market and risk a disappointing stock market debut.

A proactive move to set the company up for a better outcome in the future. An important lesson there.

A potential IPO isn't the only driver of valuation drops. The buy-now-pay-later company Klarna is reportedly in talks to raise money at a valuation of $15 billion, only 1/3 of the startup's $46 billion valuation in its June 2021 raise. We will see many more stories like this in the months to come.

And while valuation compression typically starts with later-stage startups, this trend will continue to move down the stack to earlier stages in the coming months.

Don't Fear the Down Round

The valuation of an early-stage startup is more art than science. It's a negotiated number between founders and investors. As we can see from the Instacart, DoorDash, and Klarna examples, the range of acceptable sales multiples is highly impacted by external factors.

This knowledge can free the founder to focus on the long-term success of their startup, placing far less emphasis on shifts in valuation when markets turn against them.

Yes, a lower valuation likely means more dilution for founders and their team. But it's also an opportunity to reset option prices for employees to better incentivize them for future growth. And much like Instacart, you will be better positioning your startup for future rounds of funding.

In times like this, when the pullback in valuations is broad-based, founders will find that investors don't see a down round as a roadblock to future success. And if that's what it takes to raise the cash you need to stay alive and keep fighting, it can be a worthwhile trade-off.

Be Wary of Trading Preferred Stock Rights To Preserve Valuation

Some founders will prefer to layer in more preferred stock rights to entice investors to invest at a higher valuation, simply to avoid a down round. Existing investors can be particularly receptive to this approach. They might prefer to delay a lower valuation so that they don't have to take the hit in their portfolio. Particularly when facing the same risk across many startups in their portfolio simultaneously.

Additional preferred stock rights include higher liquidation preferences, participation rights, warrant coverage, or anti-dilution protection through the inclusion of ratchets. These are weighty topics that deserve their own newsletter.

For now, suffice to say that the inclusion of these terms can dramatically reduce the potential future outcome for you and your team in an exit. You need good advisors on your side. You need to run the math. You'll often find that a lower valuation, even with higher dilution, protects more upside in a wider variety of outcomes.

Learn to Leverage Pay-To-Play (aka The Cram Down)

The concept of pay-to-play in preferred stock is relatively straightforward. It's a deal term that requires preferred investors to invest pro-rata in future financings. If an investor subject to a pay-to-play provision chooses not to invest in a funding round, they can be forced to covert their preferred stock to common stock. This stiff penalty can result in a preferred investor losing all their special rights and privileges, including pushing them to the back of the cap table with the rest of the common stockholders in an exit.

Despite what you might hear from some venture investors, pay-to-play is a legitimate tool that can benefit both the founder and your preferred investors.

For your investors, it ensures that the cap table doesn't end up with early-stage investors who ride along through future funding rounds, providing no further financial support to the company while reaping all of the benefits of their preferred rights.

For founders, when you need to raise a round of funding and the external funding environment is difficult, you can use pay-to-play to create leverage between supportive and unsupportive investors to help raise a round.

Founders shouldn't be afraid to use this leverage when raising a round is critical to the survival of their startup.

Be Methodical, Open, and Transparent

Everyone usually gets along when everything is up and to the right. But as headwinds develop, cracks can appear in the relationships between the founder, their board, and preferred investors. As you consider possible down rounds and utilizing pay-to-play provisions, you will encounter a higher level of risk from disgruntled investors that might be negatively impacted.

The best way to mitigate your own risk as a founder, and smooth the way to the best possible outcome, is to be methodical in your approach, transparent about the challenges your startup faces, and open about the approach you're taking to address them.

Always start with cutting costs and refocusing your startup as much as possible to extend your runway without additional funding. That has to be your first order of business. Share the details of your operational changes with your board. Address any concerns they may have. Get everyone aligned with your adjusted path forward.

If you decide you still need to raise more funding to extend your runway, run an open and transparent process. You may be able to run a simple, internal process to raise from existing investors. Or you may be asked to at least attempt to raise externally to build support for a more aggressive approach with existing investors if necessary.

Get external legal advice to advise you on documentation and communication. Most importantly, know your true allies among your directors and investors. You might need to build some alliances to ensure you have the board votes and investor support you need when you must make difficult decisions. As we discussed in Issue #3, not all investors are equal, and it's at times like this when those differences will become clear.

Sometimes It's Best to Walk Away…

When you raise from external investors, you've committed to working as hard as you can to ultimately achieve an outcome that, at a minimum, returns their capital and ideally provides a sufficient return to help them achieve their goals within their portfolio.

That commitment doesn't mean you have to run your startup down to zero in an attempt to satisfy investor expectations. It also doesn't mean that you have to accept financial terms that make it unlikely that you and your team will benefit economically in the most realistic exit scenarios.

When markets adjust, you can find your valuation is suddenly well below the total preference stack sitting on top of your cap table. You might feel the pressure to accept onerous terms from investors simply to continue to fund operations in the hope you can turn things around.

If you really have to raise additional funding in the next year because you can't reduce cash burn quickly enough, it's worth taking the time to ensure you're clear on what you're bridging to. Or what success looks like and how long that path might be to get there.

Sometimes the best decision is to walk away, wind down the business, return any capital that's left, and start with a clean slate. There is no shame in that decision. Many founders are going to face that choice in the next twelve months as this shakeout continues.

…Or Get Smaller, Get Profitable, and Keep Fighting

You also don't need to feel obligated to keep trying for a venture-scale outcome when it's clear that possibility is nowhere in sight. If you have a strong enough foundation of product-market fit and you're still passionate about the journey you're on, get smaller, get profitable, and keep fighting. Skip the down round, avoid those onerous deal terms, and get back to building your company at a more sustainable pace.

You can deal with that cap table and preference stack another day. That's a topic for another post.