🪤 Avoid the SAFE Note Dilution Trap

SAFEs are fast and inexpensive to use. That’s a feature and a bug.

Too many founders overuse SAFEs and end up in a dilution trap.

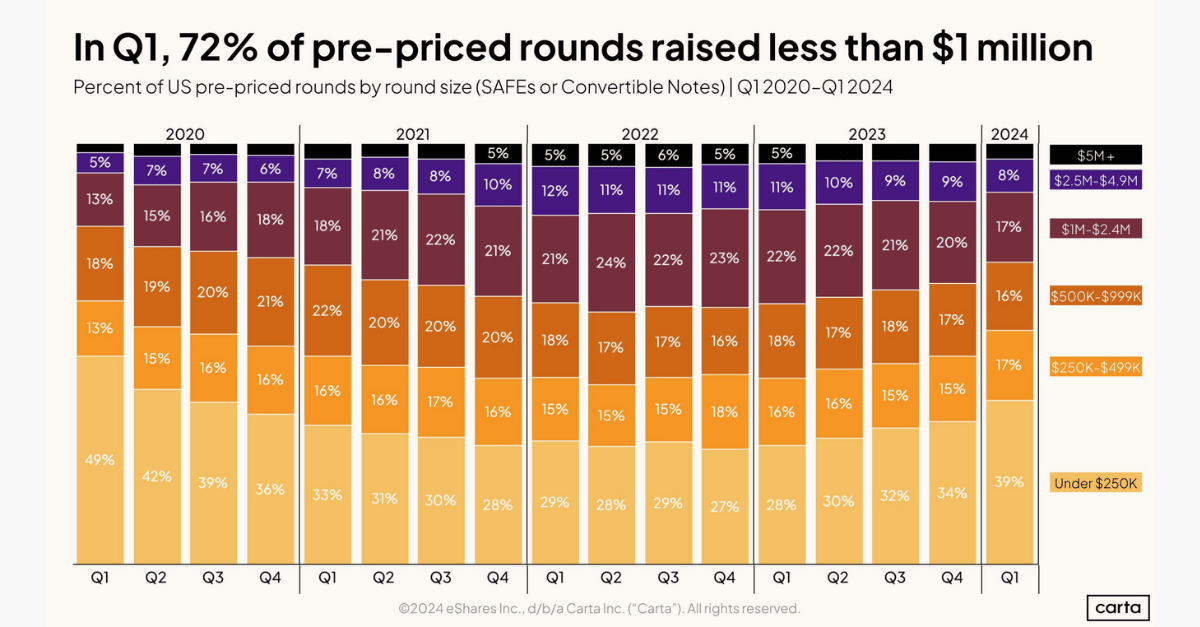

- Carta recently released its Q1 2024 State of Pre-seed report. It's the perfect opportunity to review the current state of SAFE notes and the risks and opportunities they present.

Let’s use this data to learn how to avoid the dilution trap.

👍 SAFEs are great for raising pre-seed capital

SAFE or Convertible Notes: 88% of pre-priced rounds in Q1 2024 were SAFE notes vs convertible notes.

- SAFEs avoid the need to negotiate your startup's valuation before you have enough traction to determine a fair number.

- SAFE (Simple Agreement for Future Equity) notes are truly simple agreements, often four pages or less, meaning lower legal fees and a faster time to close.

Unlike convertible notes, SAFEs aren't debt and don't create a liability that lives on your balance sheet. If you don't raise a future round and don't exit, most SAFE notes disappear. Convertible notes are a liability you either need to repay or convert to preferred stock in a future financing.

Round Size: In Q1 2024, 72% of pre-priced rounds raised less than $1 million. Most founders switched to priced equity when the round approached $3 million.

👀 Pay attention to implied dilution

Implied dilution: You can estimate implied dilution based on the post-money valuation cap and the amount you raise.

- 95% of SAFEs had a valuation cap

- 85% of valuation caps were based on post-money valuation

- Nearly 1/3 of SAFEs with valuation caps also had a discount off of the price of the next round. The average discount was 20%

Complicating the math: Valuation caps and discounts can meaningfully impact dilution from SAFEs in your next round of financing. Be aware of the risks of your next funding round pricing below your valuation cap.

Don't Forget: Valuation caps protect the investor, not your startup. SAFE notes can convert to stock at a lower valuation in a subsequent round, leading to higher-than-expected dilution.

🎯 Target max dilution, not max cash

The Negotiation: Valuation caps and discounts are the key to negotiating your SAFE notes. You're not pricing the round, but investors are considering acceptable caps and discounts based on risk, opportunity, and the size of the investment.

- If you raise too much at a cap that is too low, you're giving away too much ownership now.

- It's better to raise less, build value, and then raise a priced round.

- Align your valuation cap with your round size.

Pro Tip: When raising a pre-priced round on a SAFE, reduce the size of your raise if you can't find investors willing to accept your target valuation cap. Slow your burn and build value. That's how you manage future dilution and protect your cap table.

🔭 Work backward from your next priced round

If I want to avoid a dilution trap in the future, calculate the full impact of dilution in your future priced round.

- If you're raising a SAFE note, your goal is to raise a priced round in the future or create a bridge to an exit.

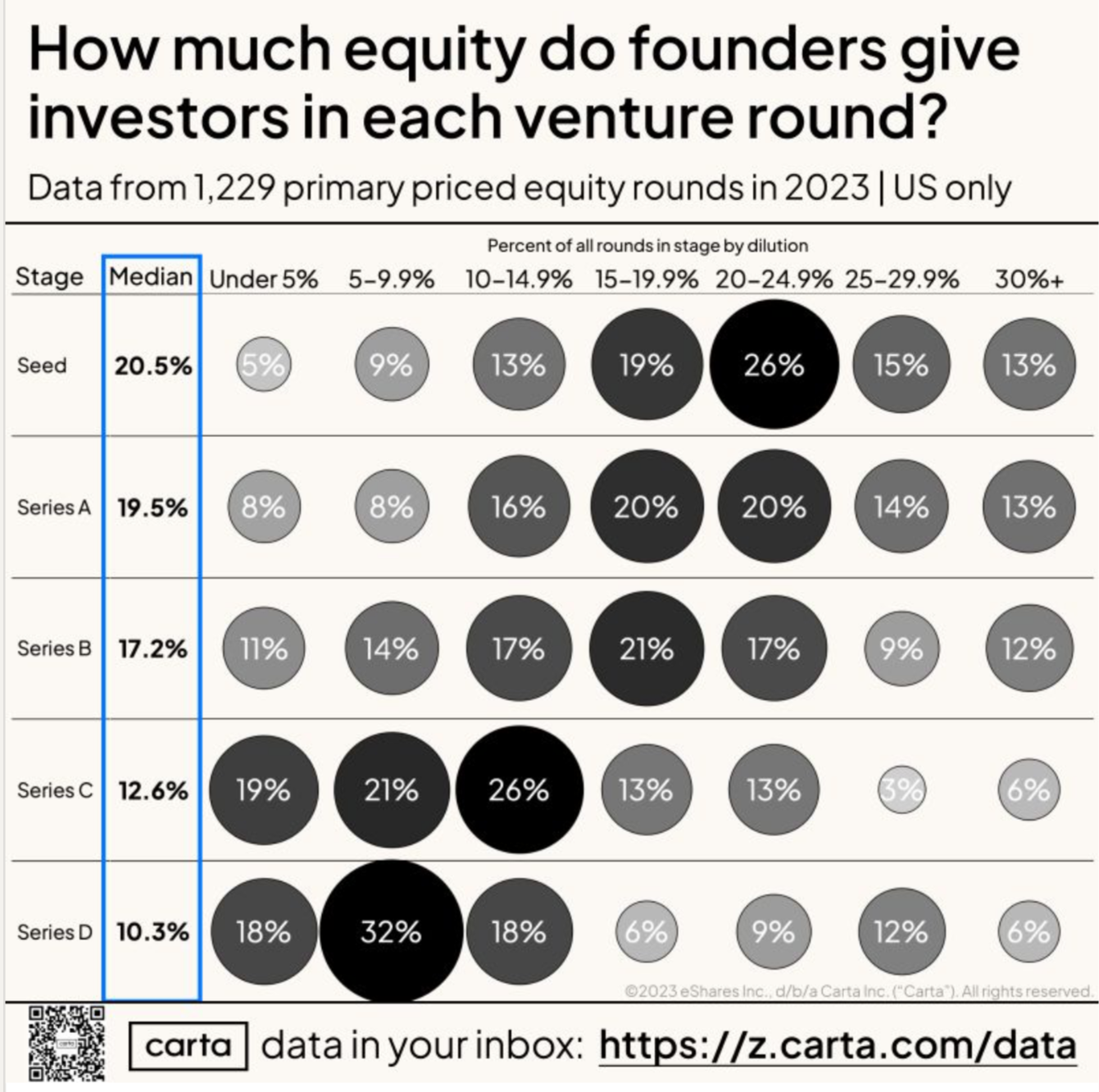

- Median seed round dilution is 20% in both Seed and Series A.

- Don't forget the impact of your employee option pool.

SAFE Conversion: Roll in the dilution impact of your SAFE notes, incorporating target valuation caps and discounts, to calculate the projected dilution at your next priced round.

Pro Tip: Take a step back. Look at your plan for the next 24-36 months. Make sure your milestones to reach your priced round are achievable. Leave some wiggle room—nothing ever goes as planned.

When you raise your SAFE, you want to be confident that the combination of the SAFE note conversion and the additional shares you issue at the time of your next priced round will not create too much dilution.

Don’t be seduced by SAFE notes

SAFEs were created to offer a fast, low-cost way to raise pre-priced early capital.

Too many founders overuse SAFE notes, using them between priced rounds to extend their startup's runway rather than making tough decisions to reduce their burn rate.

- I’ve met too many founders who don't know the true dilution impact of outstanding SAFE notes.

- As you can see, SAFE Notes can be dilution traps.

Control your startup's destiny: You can sell too much of your startup before you realize it's happening. Be smart. Pay attention to dilution, and don't take easy money on bad terms to avoid tough decisions that keep options open down the road.

Go Deeper: read the full Carta report here.