Mass Extinction Event for Startups? Are You Default Investable or Default Alive?

For many startups, the next 12 months will be challenging. Default Investable or Default Alive. Know which path you are on.

A few weeks ago, Tom Loverro of the venture fund IVP tweeted that we are on the verge of a mass extinction event for startups.

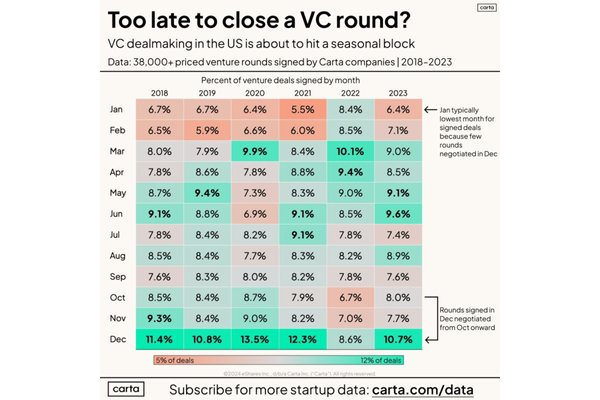

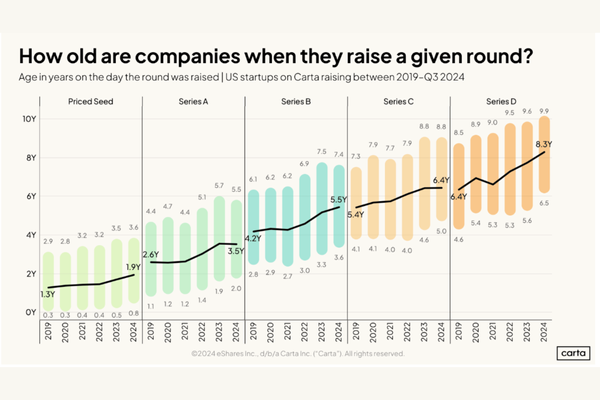

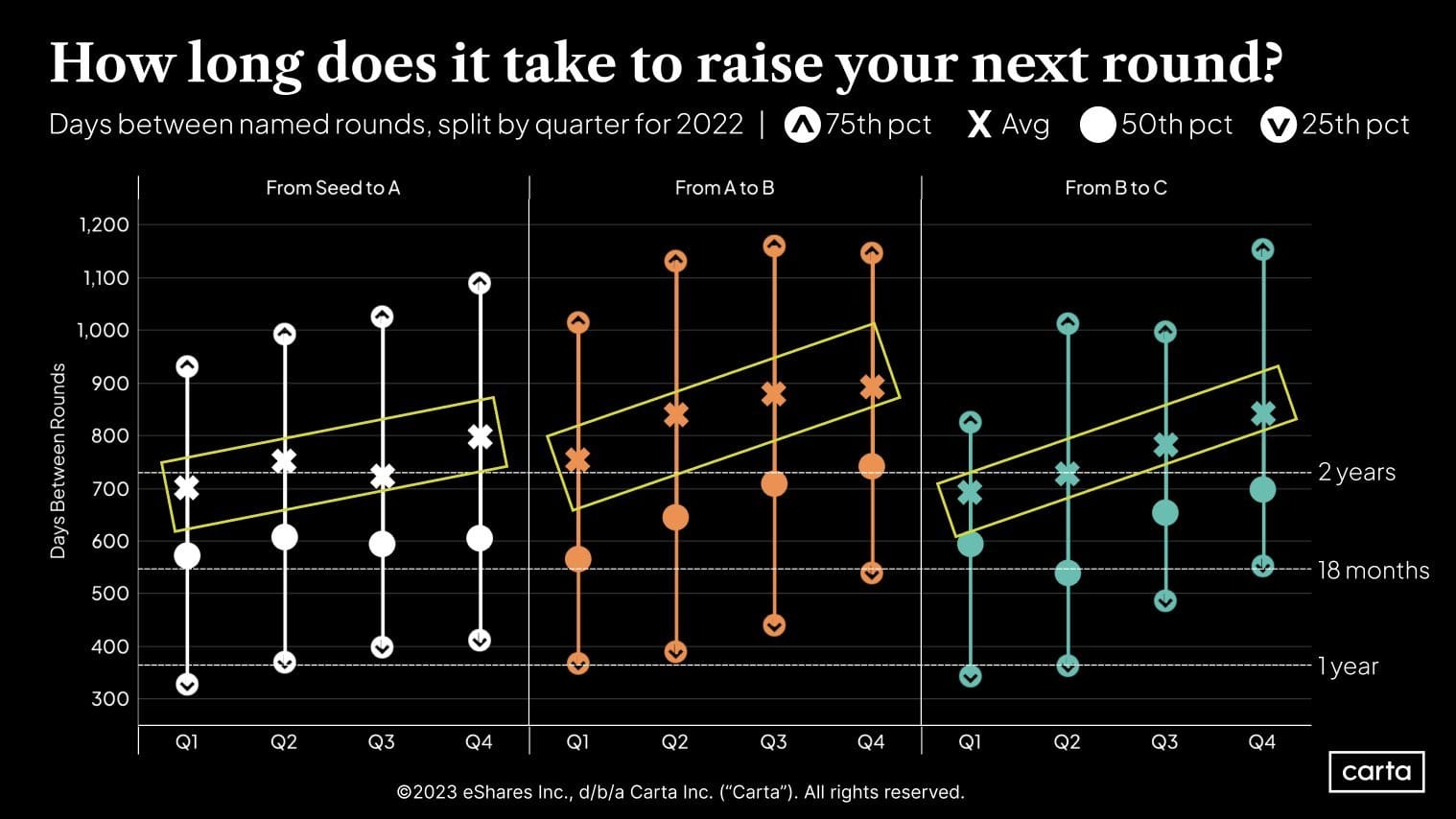

Carta shared data showing that it’s taking longer for startups to raise their next round of funding.

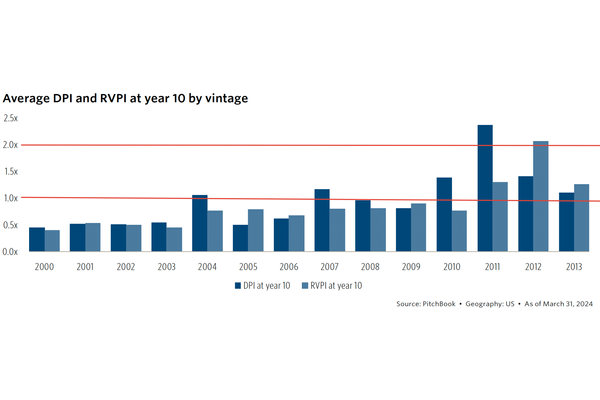

For many startups, the next 12 months will continue to be fraught with peril. Venture funds will continue focusing on their highest potential startups, leaving much of their portfolio to fend for themselves.

Now is an excellent time to revisit the concepts of Default Investable and Default Alive.

Your first goal is to remain Default Investable

Default Investable means maintaining sufficient revenue growth and progress on key metrics to keep the promise of venture-scale returns alive for future investors. You need to balance the goal of remaining Default Investable while extending your runway to give you more time to raise your next round of funding. It’s a tricky balance. Spending too aggressively on customer acquisition to drive sales growth accelerates your cash burn. Pull back too far, and your growth rates will drop you out of the Default Investable zone.

Navigating this path requires a relentless focus on your monthly burn rate, your unit economics and a willingness to shut down unproductive initiatives to focus all of your resources on your highest potential work.

Even as you do this, keep an eye on investor sentiment in your space, trends on valuation multiples and M&A activity. Remember that external events can move the goalposts despite your best efforts, particularly in the current funding environment.

Determine if Default Alive is an option

As your runway slips below 12 months, you need to determine whether you have a path to Default Alive and at what point you might need to shift your stance from Default Investable.

Default Alive means that you have a foundation of product-market fit that will sustain positive cash flow and profitability, allowing you to keep the business alive even if you can’t raise additional venture capital.

Keep three things in mind as you pursue the Default Alive path.

1. Default Alive is not an option for every startup

If you don’t have product-market fit at a sufficient scale, there is no path to enough positive cash flow and profitability to stay alive.

2. You will leave Default Investable behind

As you slow your growth to reach Default Alive, you increase the likelihood that your startup is no longer Default Investable. Consecutive quarters of low growth won’t convince many investors that you can accelerate growth in the future. Once you’re off the venture track, getting back on is extremely difficult.

3. You might be running a small business

You envisioned $100 million run rates and billion-dollar valuations when you first launched your startup and raised that seed round of funding. But your island of profitable, cash-flow-positive product-market fit is much smaller. Do you want to run that company? Are you passionate about the mission and enjoying the journey enough for that ride to be attractive? Are you ready for a slower growth future, with a much greater emphasis on operational excellence and incremental margin improvements?

For some founders, the answer is no. That’s ok. It’s better to be honest about that and make your decisions accordingly.

Default Investable or Default Alive. Know which path you are on, and make decisions accordingly. If your startup has yet to reach escape velocity, with your next round of funding or an exit strategy assured, stay disciplined. Keep one eye on the metrics that matter and the other on the macro factors impacting your target investors. Stay in control of your destiny.